Link PAN with Aadhaar: PAN and Aadhaar are two unique identification cards issued by the Indian government. Linking them together has been made mandatory to streamline financial transactions and prevent tax evasion. Remember, there is a deadline for linking PAN with Aadhaar, which is currently set for June 30, 2023. If you miss this deadline, your PAN card may become inoperative, causing inconvenience in financial transactions. So, it’s essential to complete the linking process before the deadline to avoid any penalties or disruptions.

Make sure to link your PAN with Aadhaar before the deadline to avoid penalties and any inconvenience in your financial transactions.

Updates: Section 139AA of the Income Tax Act stipulates that individuals who have been allotted a PAN on or before July 1, 2017, and are eligible to obtain an Aadhaar card must link the two. The deadline for linking PAN with Aadhaar was initially set for March 31, 2022, without fee payment, and later extended to March 31, 2023, with prescribed fee payment (CBDT Circular No.7/2022). However, the latest deadline for PAN-Aadhaar linking is now June 30, 2023, after which PAN cards will become inoperative if not linked.

Table of contents

- Quick Summary Table for Link PAN with Aadhaar

- Prerequisites to Link PAN with Aadhaar:

- Checking Aadhaar-PAN Linking Status: A Step-by-Step Guide

- Link Aadhaar PAN Status Scenarios

- How to Link PAN with Aadhaar Step-by-Step Procedure

- Consequences of Not Linking PAN with Aadhaar

- Who is Not Required to Link PAN with Aadhaar?

- Aadhaar-PAN Mismatch: How to Correct Your Details for Linking

- FAQ - Linking PAN with Aadhaar

Quick Summary Table for Link PAN with Aadhaar

| Method | Steps |

|---|---|

Payment of Penalty/Fee Procedure |

1.Visit e-Filing Portal Home page or log in to the e-Filing portal and click on “Link Aadhaar” or “Link Aadhar” 2.Enter your PAN and Aadhaar Number 3.Click on “Continue to Pay Through e-Pay Tax” 4.Enter PAN, confirm PAN, and provide a mobile number for OTP verification 5.Get redirected to the e-Pay Tax page after OTP verification 6.Click on “Proceed” on the Income Tax Tile 7.Select Assessment Year and choose “Other Receipts (500)”. Click on “Continue.” 8.The applicable amount will be pre-filled under “Others.” Click on “Continue.” After that you can go to the section Link Aadhaar. The following steps will let you know to link PAN with Aadhaar after payment of fee/penalty. |

Method 1: Link Aadhaar Without Logging in |

1. Visit the Income Tax e-Filing Portal. 2. Click on the ‘Link Aadhaar’ tab under Quick Links. 3. Enter your PAN and Aadhaar number, along with your name and registered mobile number. 4. Validate the entered details using the OTP received on your mobile number. 5.”If you have already made the payment, you will receive a message confirming that “your payment details have been verified”. If you have not made the payment yet, you will need to follow the above steps to complete the payment process.” 5. That’it. Now, check the status by clicking “Link Aadhaar Status”. |

| Method 2: Link Aadhaar by Logging in | 1. Log in to your account on the Income Tax e-Filing Portal. 2. Go to the ‘Link Aadhaar’ section under ‘My Profile’ or ‘Personal Details’. 3. Enter your Aadhaar number and validate it to confirm successful linkage. |

| Method 3: Link Aadhaar via SMS | 1. Send an SMS in the specified format to either 567678 or 56161 from your registered mobile number. 2. Use the format: UIDPAN <12-digit Aadhaar number><space> <10-digit PAN>. 3. Example: UIDPAN 123456789101 ABPCD1024P. |

Check Status (PAN Aadhaar Link or Not) |

1. Go to the e-Filing Portal homepage and click on “Link Aadhaar Status” under the Quick Links section. 2. Enter your PAN and Aadhaar Number, and click on “View Link Aadhaar Status.” 3. Once the validation is successful, you will receive a message indicating your Link Aadhaar Status. If the Aadhaar-PAN link is in progress: 1. The status will indicate that the linking process is currently underway. If the Aadhaar-PAN linking is successful: 2. You will receive a confirmation message stating that the link has been successfully established. |

Prerequisites to Link PAN with Aadhaar:

To fast the process of linking your PAN card with your Aadhaar card, it is helpful to have certain information readily available. By keeping these items ready, you can streamline the PAN-Aadhaar linking process and complete it smoothly. Here are a few things to keep in mind before initiating the PAN-Aadhaar linking process:

1. Valid PAN Card: Ensure that you have a valid PAN card issued by the Income Tax Department. If you don’t have a PAN card, you will need to apply for one before proceeding with the linking process.

2. Valid Aadhaar Card: Ensure that you have a valid Aadhaar card issued by the Unique Identification Authority of India (UIDAI). If you don’t have an Aadhaar card, you will need to enroll for one and obtain the unique 12-digit Aadhaar number.

4. Active Internet Connection: Since the linking process is done online, you will need a stable internet connection to access the official e-filing website of the Income Tax Department and complete the linking procedure.

5. Valid Mobile Number: Make sure you have a mobile number registered with UIDAI and linked to your Aadhaar card. This is essential as you may receive an OTP (One-Time Password) on your registered mobile number for authentication during the linking process.

6. Access to the Income Tax Department’s Website: Ensure that you have access to the official e-filing website of the Income Tax Department. You will need to navigate to the PAN-Aadhaar linking section on the website to initiate the process.

By having these prerequisites in place, you will be ready to link your PAN with Aadhaar seamlessly and ensure compliance with the government’s requirements.

Checking Aadhaar-PAN Linking Status: A Step-by-Step Guide

Checking the Linking Status of Aadhaar with PAN Card:To determine whether your Aadhaar is linked to your PAN card, you can follow these steps:

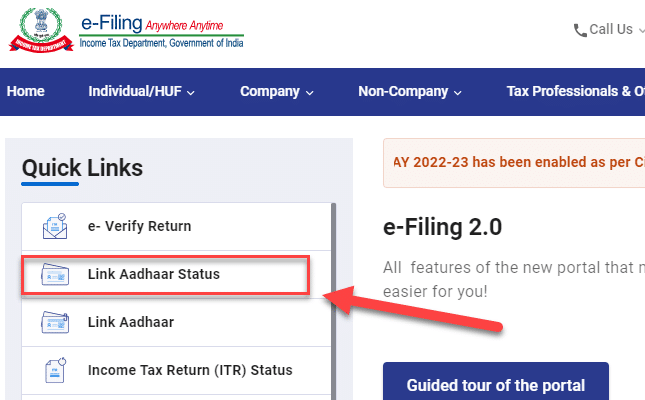

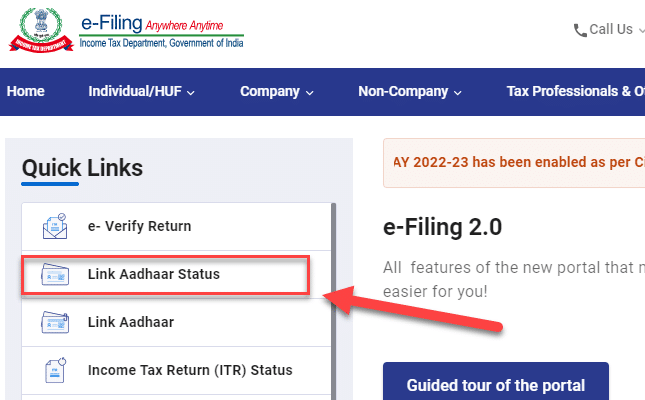

Step 1: Visit the official Income Tax e-filing website and navigate to the ‘Link Aadhaar Status’ page, which can be found under the quick links on the homepage.

Step 2: On the ‘Link Aadhaar Status’ page, enter your PAN number and Aadhaar number accurately.

Step 3: Click on ‘View Link Aadhaar Status’ to proceed.

Step 4: The system will validate the provided details and display the status of your Aadhaar-PAN linking.

Step 5: Checking Aadhaar-PAN Linking Status:

When checking the linking status of your Aadhaar with PAN, you may come across the following scenarios:

Link Aadhaar PAN Status Scenarios

1. Aadhaar-PAN Not Linked: If your Aadhaar and PAN are not linked, a pop-up notification will appear, indicating that you need to link them. Simply follow the instructions provided to initiate and complete the linking process.

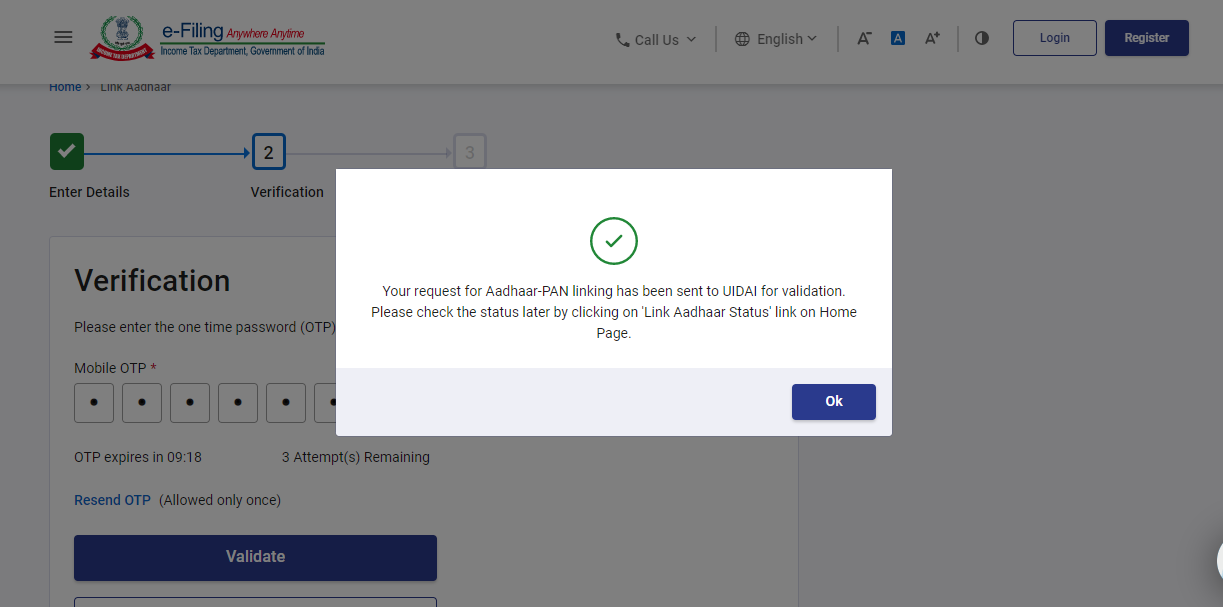

2. Aadhaar-PAN Linking in Progress: In some cases, the system may inform you that the validation is underway for the Aadhaar-PAN linking. In such instances, you will need to check the status later to verify if the linking process has been completed successfully.

3. Aadhaar-PAN Linked Successfully: Upon successful linking of your Aadhaar with PAN, you will receive a confirmation message, indicating that the linkage has been established. This assures you that your Aadhaar and PAN are now successfully linked.

By being aware of these different scenarios, you can stay informed about the status of your Aadhaar-PAN linking and take appropriate action if necessary.

Note the following:

If you find that your Aadhaar is linked with another PAN or your PAN is linked with another Aadhaar, you may need to contact the Jurisdictional Assessing Officer to delink your Aadhaar and PAN accordingly.

How to Link PAN with Aadhaar Step-by-Step Procedure

There are three methods to link your Aadhaar with PAN: without logging in to your account, logging in to your account, or via SMS. Here are the steps for each method:

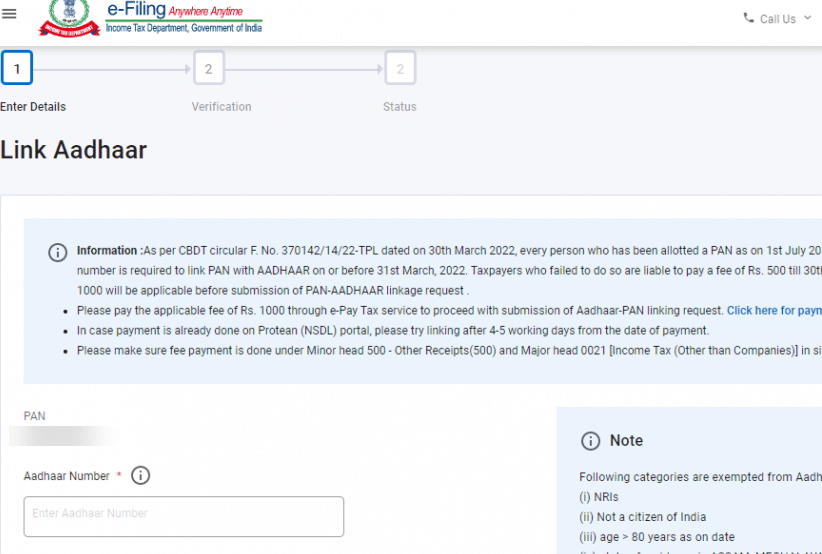

Step-by-Step Guide to Paying Penalty Fee for Linking PAN with Aadhaar

It is advisable to check the status of your PAN-Aadhaar link before proceeding with the payment of the penalty.

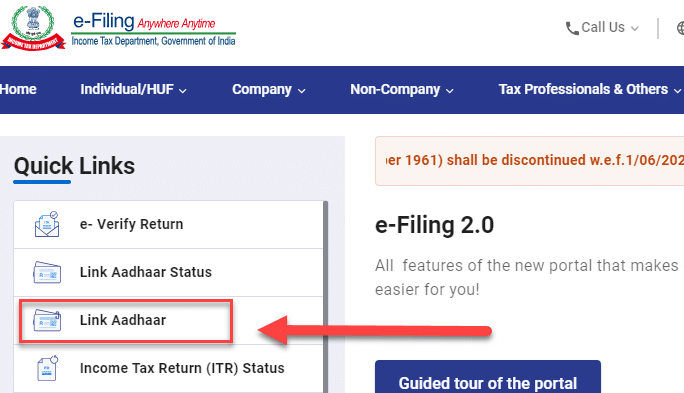

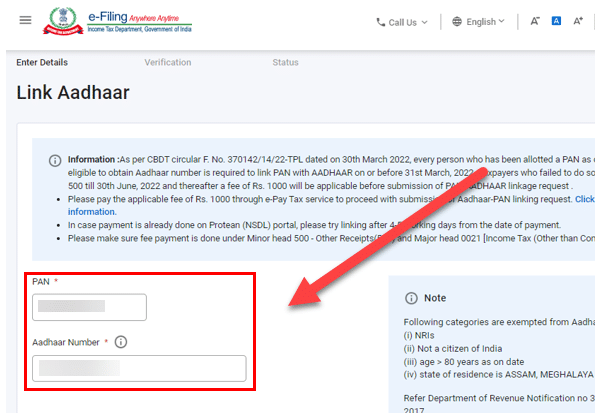

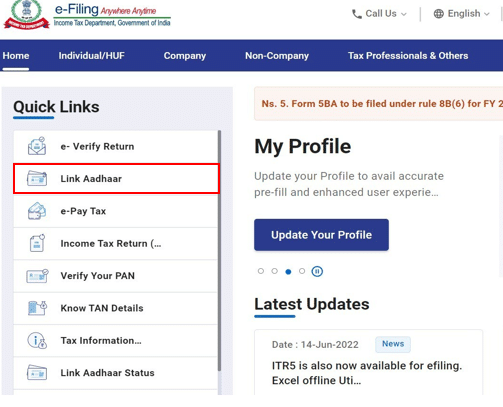

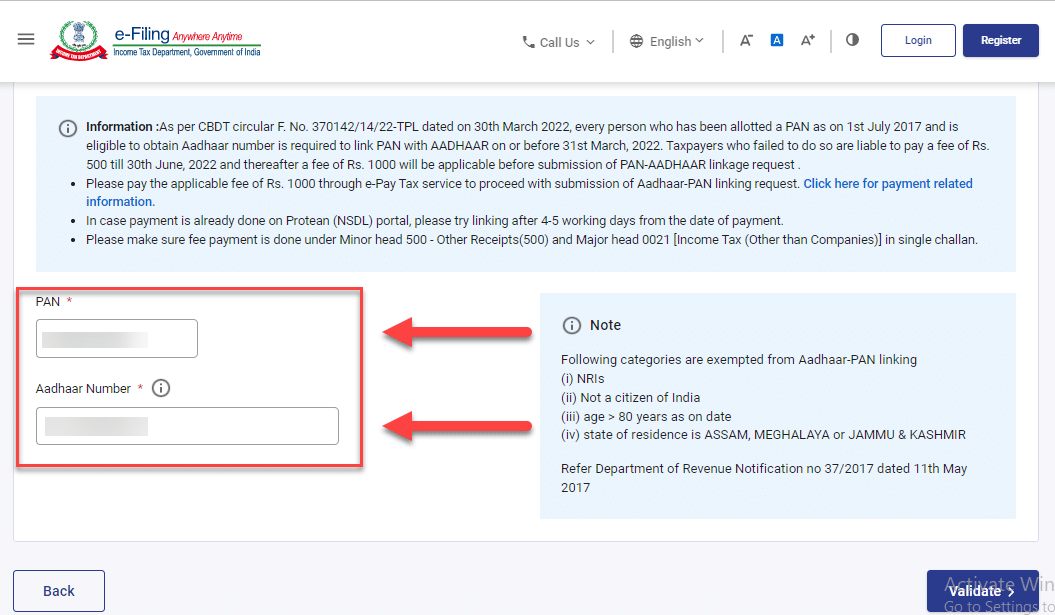

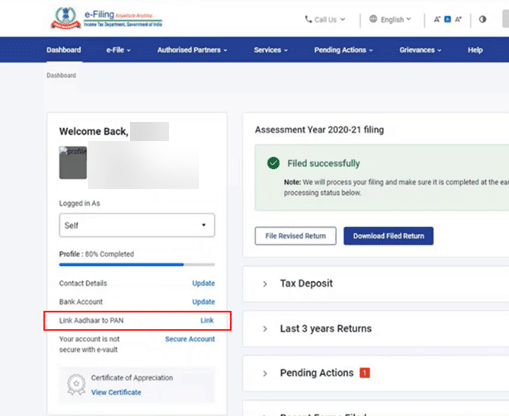

Step 1: Visit the e-Filing Portal Home page and click on “Link Aadhaar” in the Quick Links section. Alternatively, log in to the e-Filing portal and click on “Link Aadhar” in the Profile section.

Step 2: Enter your PAN and Aadhaar Number.

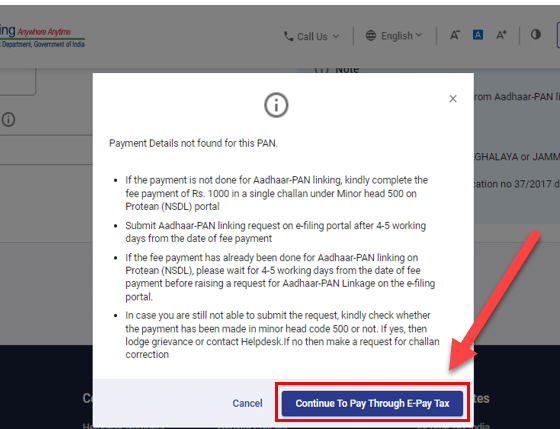

Step 3: Click on “Continue to Pay Through e-Pay Tax.”

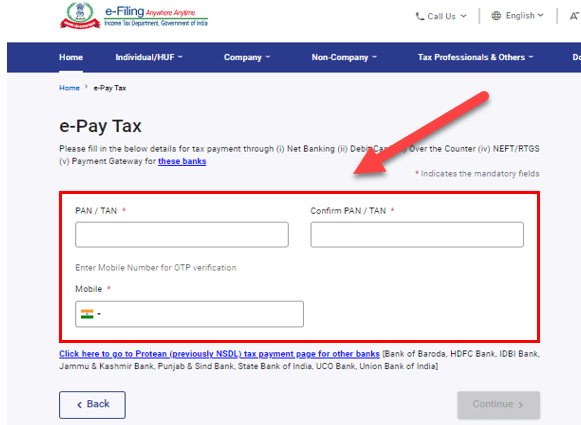

Step 4: Enter your PAN, confirm PAN, and provide a mobile number to receive an OTP (One-Time Password).

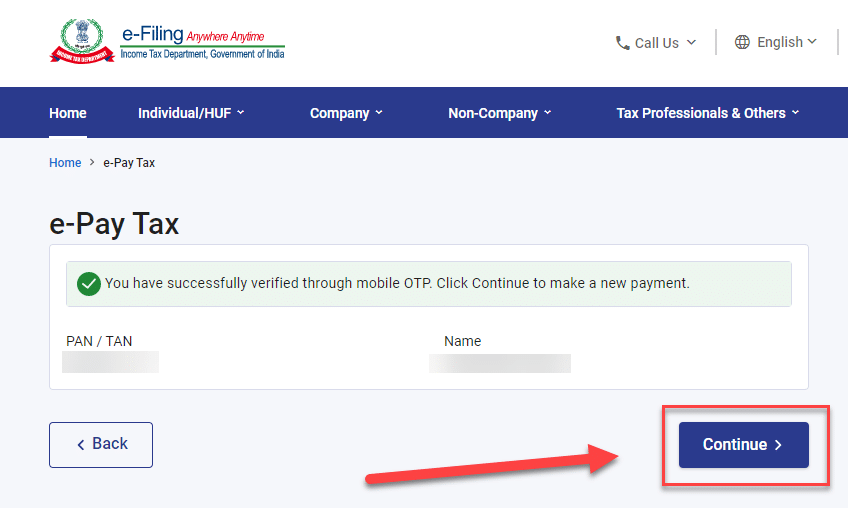

Step 5: After OTP verification, you will be redirected to the e-Pay Tax page.

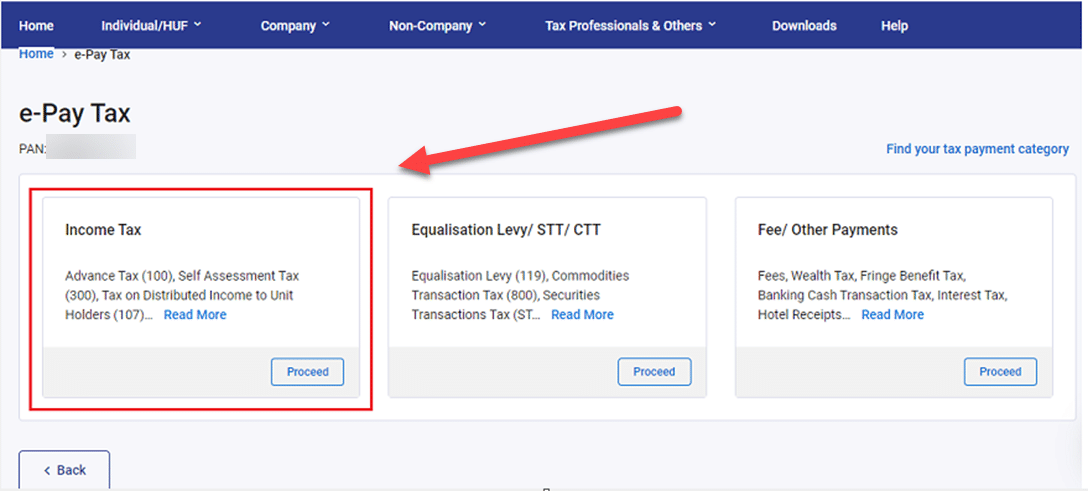

Step 6: Select Income Tax Column and Click on “Proceed”.

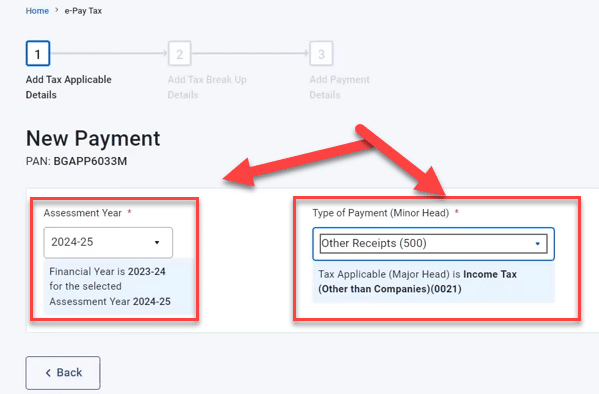

Step 7: Select the Assessment Year (2024-25) and choose the Type of Payment as “Other Receipts (500).” Click on “Continue.” (From the date 1st April 2023 to 31st March 2024, the assessment year will be 2024-25).

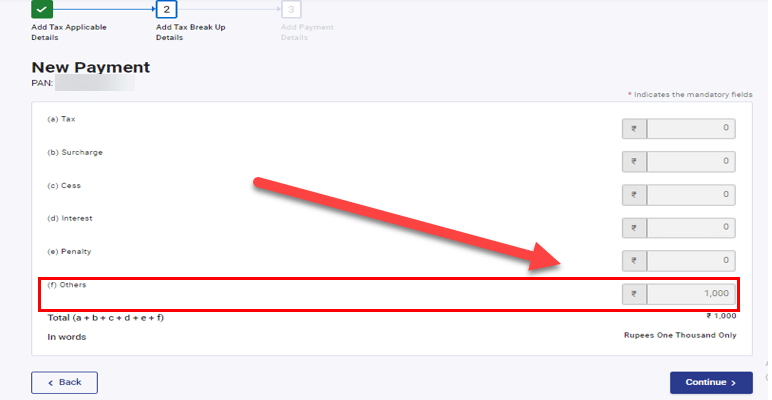

Step 8: The applicable amount will be pre-filled under “Others.” Click on “Continue.”

Now, a challan will be generated. On the next screen, you will need to select the mode of payment. After selecting the mode of payment, you will be redirected to the bank’s website where you can proceed to make the payment.

Method 1: Without logging in to your account:

Step 1: Visit the Income Tax e-Filing Portal and click on the ‘Link Aadhaar’ tab under Quick Links.

Step 2: Enter your PAN and Aadhaar number.

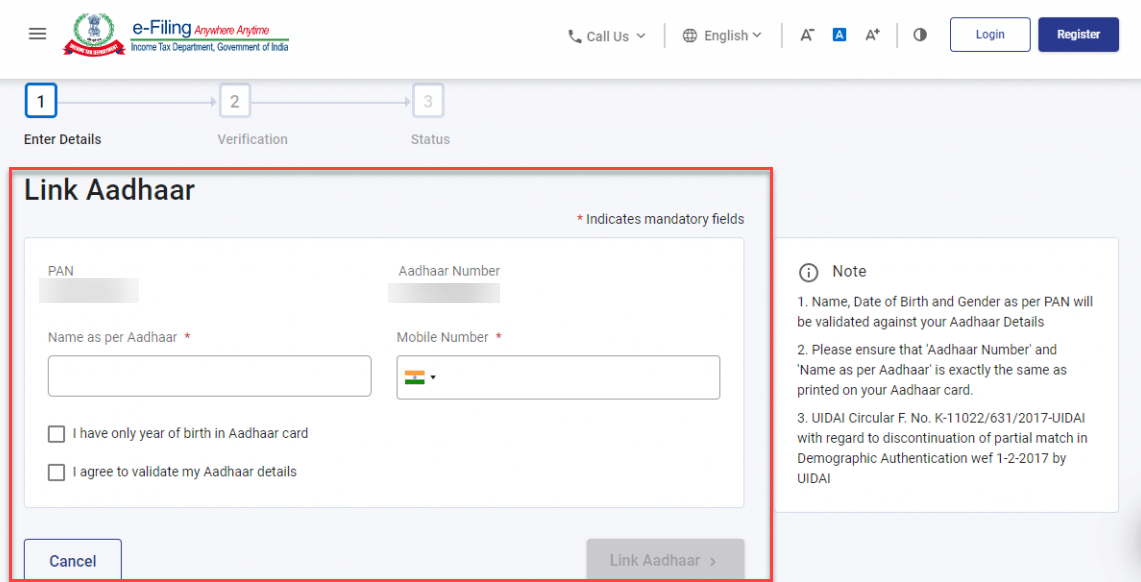

Step 3: Enter your name (as per the Aadhaar card) and mobile number.

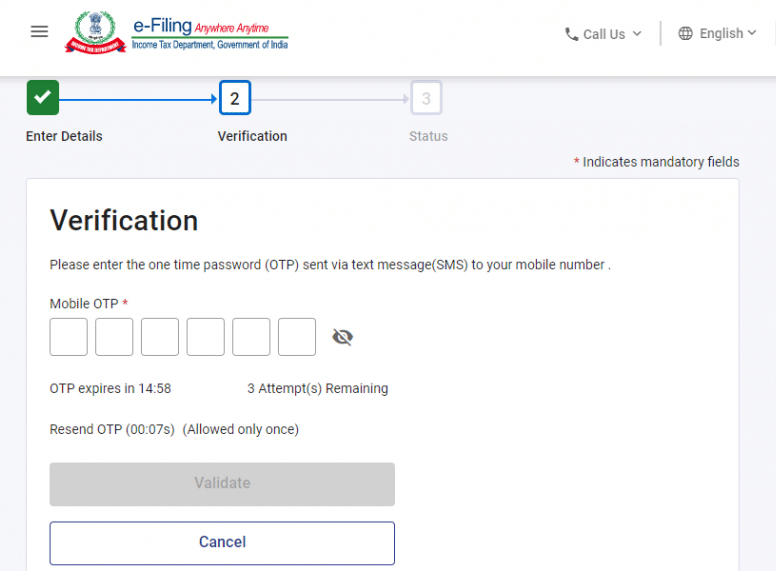

Step 4: Validate the details by entering the OTP received on your mobile number.

Step 5: If the payment details are not verified on the e-Filing portal, you will be prompted to pay the fee using the e-Pay Tax service before proceeding with the Aadhaar PAN link request.

If you have already made the payment on the Protean (NSDL) Portal, you can wait for 4-5 working days before submitting the request.

Method 2. Logging in to your account:

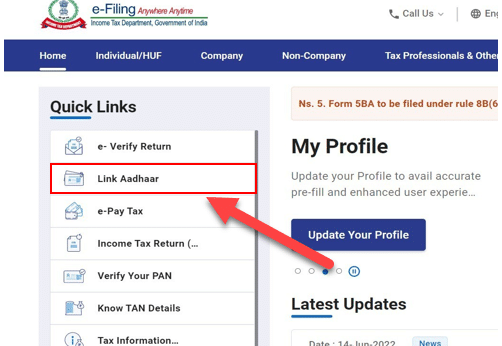

Step 1: Log in to your account on the Income Tax e-Filing Portal.

Step 2: Go to the ‘Link Aadhaar’ section under ‘My Profile’ or ‘Personal Details’.

Step 3: Enter your Aadhaar number and validate it.

Step 4: You will receive a pop-up message confirming the successful linkage of your Aadhaar and PAN.

Method 3. Via SMS:

Step 1: Send an SMS in the specified format to either 567678 or 56161 from your registered mobile number.

Step 2: Use the format: UIDPAN <12-digit Aadhaar number><space> <10-digit PAN>.

Step 3: Example: UIDPAN 123456789101 ABPCD1024P.

Make sure to enter the correct details and link your PAN with the appropriate Aadhaar card. If you encounter any issues, such as an already linked PAN or Aadhaar, contact your Jurisdictional Assessing Officer for further assistance.

Consequences of Not Linking PAN with Aadhaar

Not linking your PAN with Aadhaar can have various consequences. Here are some potential outcomes to consider:

1. Limitations in Financial Transactions: Failing to link your PAN with Aadhaar may restrict you from engaging in certain financial transactions. These limitations can include:

– Inability to file income tax returns online

– Difficulty in opening a bank account

– Ineligibility to apply for loans

– Restrictions on investing in mutual funds

2. Loss of Government Benefits and Subsidies: Linking PAN with Aadhaar is often necessary to access government benefits and subsidies. Not linking the two may result in:

– Inability to receive government subsidies or benefits

– Difficulties in accessing government schemes and programs

3. Re-KYC Requirements by Banks: If your PAN is not linked with Aadhaar, banks will require you to undergo re-KYC (Know Your Customer) procedures. This is due to the recent requirement of Aadhaar-based verification by banks.

4. Impact on Investment Accounts: Accounts linked to your PAN, such as NPS (National Pension System), PPF (Public Provident Fund), and Demat accounts, may be affected if your PAN is not linked with Aadhaar. It is important to ensure the linkage to prevent any disruption in these accounts.

5. Higher TDS or TCS Deductions: Non-linkage of PAN with Aadhaar can lead to higher deductions of TDS (Tax Deducted at Source) or TCS (Tax Collected at Source). Aadhaar has become an important tool for the government to track income and expenses, and its absence may result in increased tax deductions.

Who is Not Required to Link PAN with Aadhaar?

If you fall under any of these exemptions, you are not required to link your PAN with Aadhaar. However, it is important to note that there are some benefits to linking PAN with Aadhaar

| Exemption | Details |

|---|---|

| Individuals who are 80 years of age or older | Individuals who are 80 years of age or older are exempt from linking PAN with Aadhaar. This exemption is provided because the government acknowledges that these individuals may face difficulties in obtaining an Aadhaar card. |

| Non-Resident Indians (NRIs) | Non-Resident Indians (NRIs) are exempt from linking PAN with Aadhaar. This exemption exists because NRIs are not required to hold a PAN card in India. |

| Individuals who do not have an Aadhaar card | Individuals who do not possess an Aadhaar card are exempt from linking PAN with Aadhaar. However, they can still apply for an Aadhaar card through the Unique Identification Authority of India (UIDAI). |

| Individuals residing in Assam, Jammu and Kashmir, and Meghalaya | Individuals residing in the states of Assam, Jammu and Kashmir, and Meghalaya are exempt from linking PAN with Aadhaar. This exemption is due to the non-implementation of the Aadhaar scheme in these states by the government. |

Even if you don’t have to link your PAN with Aadhaar due to an exemption, there are still advantages to doing so. For example, it allows you to file your income tax returns online and take advantage of different government schemes and benefits. So, it’s beneficial to link your PAN with Aadhaar even if you are exempted.

Aadhaar-PAN Mismatch: How to Correct Your Details for Linking

If you encounter a situation where you are unable to link your Aadhaar with PAN due to a mismatch in your name, phone number, or date of birth, it is essential to take the necessary steps to correct the details. Here is step by step guidance to correc the mismatched details in either your PAN or Aadhaar database.

Correcting PAN Details: To rectify the mismatched details in your PAN, you have two options:

1. TIN-NSDL Website: Visit the TIN-NSDL website at https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html and follow the provided instructions to correct your PAN details.

2. UTIISL’s PANOnline Portal: Access UTIISL’s PANOnline Portal at https://www.pan.utiitsl.com/PAN/mainform.html;jsessionid=B3A9443C26F9755063EFD5A7B32B2E11 to correct your PAN details as per the given guidelines.

Correcting Aadhaar Details: To rectify the mismatched details in your Aadhaar, you need to follow these steps:

1. UIDAI Website: Visit the UIDAI website at https://uidai.gov.in/my-aadhaar/update-aadhaar.html, where you will find the necessary instructions and guidelines to correct your Aadhaar details. It is recommended to visit an Aadhaar Suvidha Center located in your nearby area.

FAQ – Linking PAN with Aadhaar

Q1: Why is it important to link PAN with Aadhaar?

A: Linking PAN with Aadhaar has been made mandatory by the Indian government to streamline financial transactions and prevent tax evasion. It is essential to complete the linking process before the deadline to avoid any penalties or disruptions in financial transactions.

Q2: What is the deadline for linking PAN with Aadhaar?

A: The current deadline for linking PAN with Aadhaar is June 30, 2023. Failure to link before this deadline may result in your PAN card becoming inoperative.

Q3: What are the consequences of not linking PAN with Aadhaar?

A: Not linking PAN with Aadhaar can lead to limitations in financial transactions, loss of government benefits and subsidies, re-KYC requirements by banks, impact on investment accounts, and higher TDS or TCS deductions.

Q4: How can I link PAN with Aadhaar?

A: There are three methods to link PAN with Aadhaar:

– Method 1: Link Aadhaar without logging in to your account

– Method 2: Link Aadhaar by logging in to your account

– Method 3: Link Aadhaar via SMS

Q5: What are the prerequisites for linking PAN with Aadhaar?

A: To link PAN with Aadhaar, you need a valid PAN card, a valid Aadhaar card, an active internet connection, a registered mobile number linked to Aadhaar, and access to the Income Tax Department’s e-filing website.

Q6: How can I check the linking status of my Aadhaar with PAN?

A: You can check the linking status by visiting the Income Tax e-filing website, navigating to the ‘Link Aadhaar Status’ page, entering your PAN number and Aadhaar number, and clicking on ‘View Link Aadhaar Status’.

Q7: Who is not required to link PAN with Aadhaar?

A: Individuals who are 80 years of age or older, non-resident Indians (NRIs), individuals who do not have an Aadhaar card, and individuals residing in Assam, Jammu and Kashmir, and Meghalaya are exempt from linking PAN with Aadhaar.

Q8: What should I do if I encounter an Aadhaar-PAN mismatch?

A: If you encounter a mismatch in your name, phone number, or date of birth while linking Aadhaar with PAN, you can correct the details by following the instructions provided by either the TIN-NSDL website or UTIISL’s PANOnline Portal.

Q9: Is it beneficial to link PAN with Aadhaar even if I am exempted?

A: Yes, it is beneficial to link PAN with Aadhaar even if you are exempted. It allows you to file income tax returns online and take advantage of various government schemes and benefits.

Q10: What is the step-by-step procedure for paying the penalty fee for linking PAN with Aadhaar?

A: The step-by-step procedure for paying the penalty fee includes visiting the e-Filing Portal, entering PAN and Aadhaar details, continuing to pay through e-Pay Tax, entering OTP for verification, proceeding to the Income Tax tile, selecting assessment year and type of payment, and making the payment through the bank’s website.

This info was good i.e. if you have AC. However, you have not addressed the issue of NRIs who do not have Aadhar Card and are unable to obtain it overseas. In this case how are they going to file the IT returns? Can you please explain? Thanks – Oswald