In this article, you will learn how to file & view 15CA & 15CB with step by step procedure. All steps where it is necessary are given with pictures from official income tax department website. Check it out, the detail article given on 15CA & 15CB procedure. You can also ask your queries via comment form regarding form 15CA & 15CB.

Form 15CA is a form which is filed before making the payment to a non-resident. It can be filed only by a user holding a valid PAN/ TAN (any of both). The user should also be registered with e-filing. If the user is not registered then he has to get himself registered first.

Procedure to File Form 15CA

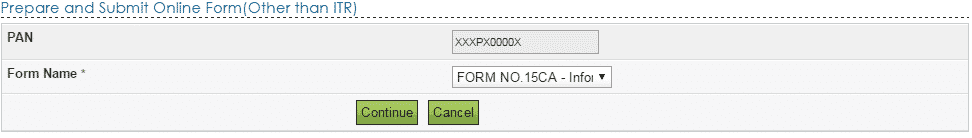

Step 1: Login to e-filing website, click on E-file. Then click on Prepare and Submit online forms (Other Than ITR). Following screen will be displayed. Step 2: Select Form 15CA from the drop down menu under the Form Name option.

Step 2: Select Form 15CA from the drop down menu under the Form Name option.

(Note: In case of TAN users DSC is mandatory to file Form 15CA)

Step 3: Generate signature for a zip file using DSC management utility and upload the generated signature files.

(Note: To download the DSC management utility, click on https://incometaxindiaefiling.gov.in/ and under the downloads head click on DSC management utility)

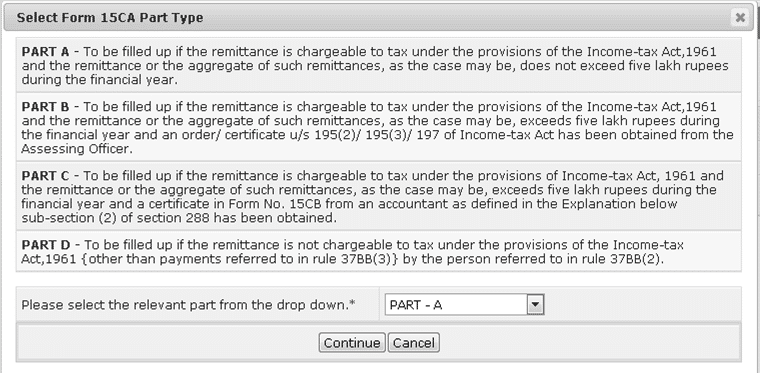

Step 4: Click on Continue button. A pop up will appear as below. Choose the relevant part of the form 15CA as may be applicable to you.

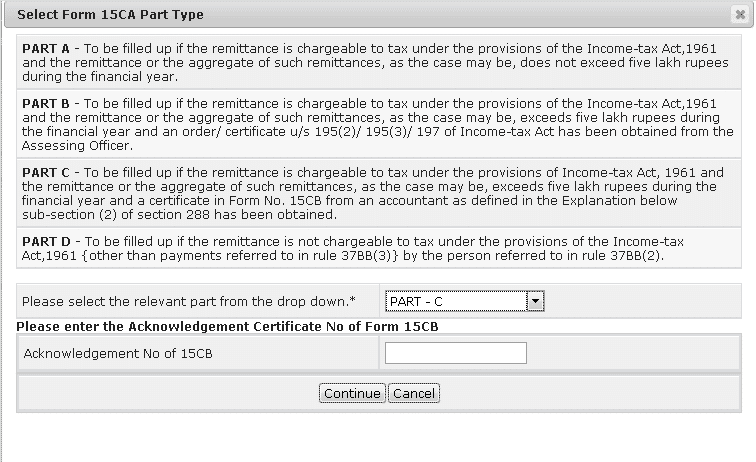

(Note: If you want to file Part C of the Form 15CA, filing of Form 15CB is mandatory before the filing of Form 15CA. The details in Part C of the form 15CA, the acknowledgement number of the e-filed Form 15CB is required, as shown below.)

(Note: If you want to file Part C of the Form 15CA, filing of Form 15CB is mandatory before the filing of Form 15CA. The details in Part C of the form 15CA, the acknowledgement number of the e-filed Form 15CB is required, as shown below.)

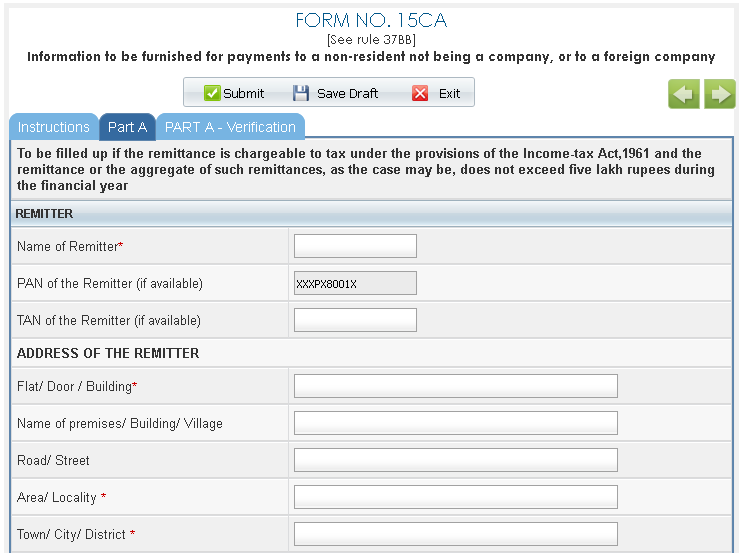

Step 5: Click on Continue button. Following screen will be displayed:

Step 5: Click on Continue button. Following screen will be displayed:

Step 6: Fill the necessary details and click on Submit.

Step 6: Fill the necessary details and click on Submit.

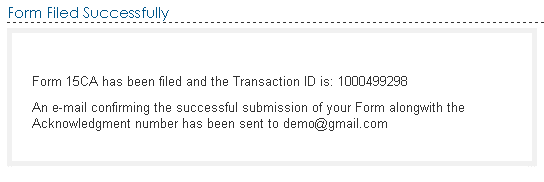

Step 7: The user will be redirected to Success page as shown below.

Procedure to View Form 15CA

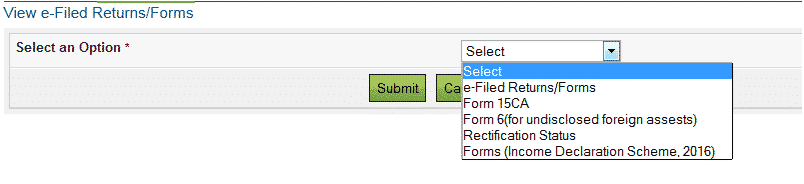

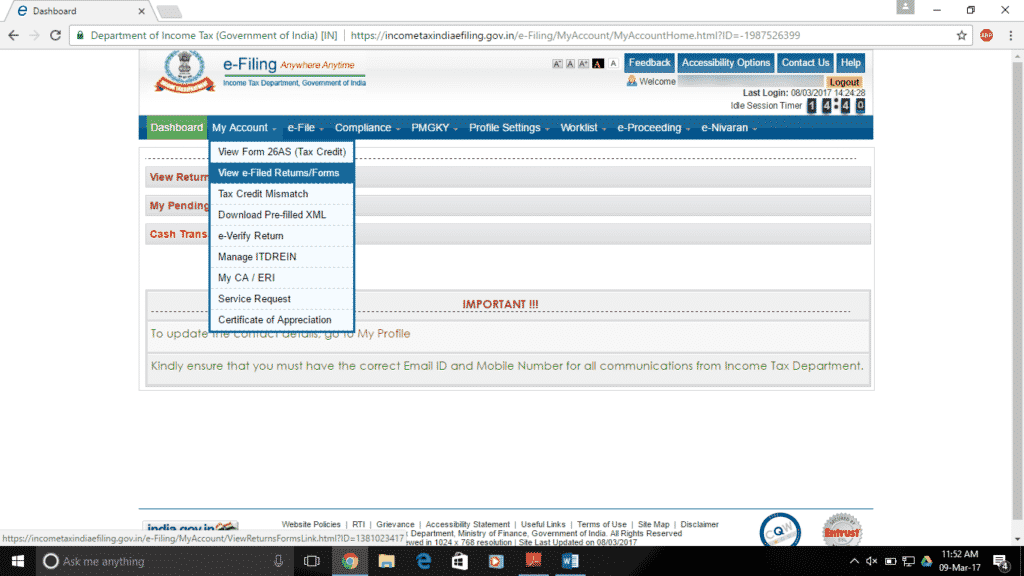

Step 1: To view the submitted Form 15CA, you must log in to your account and navigate to My account, then click on View e-filed Returns/Forms.

Step 2: Select the Form 15CA from the drop down menu as shown below.

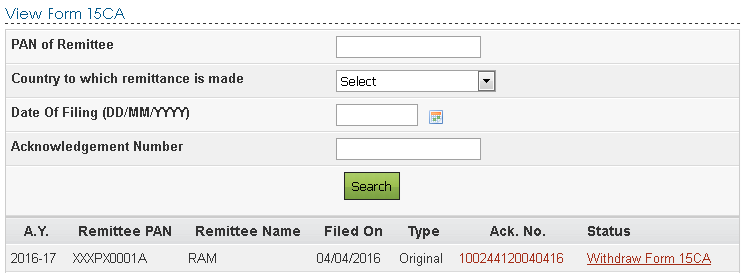

Step 3: Click on Submit button. The following screen will be displayed:

Step 3: Click on Submit button. The following screen will be displayed:

(Advance Search is also available to filter the search criteria.)

(Note: “Withdraw Form 15CA” link is also available to users if they wanted to withdraw uploaded Form 15CA. The Form 15CA can be withdrawn within 7 days of the submission of the form.)

(Note: “Withdraw Form 15CA” link is also available to users if they wanted to withdraw uploaded Form 15CA. The Form 15CA can be withdrawn within 7 days of the submission of the form.)

Step 4: Click on Withdraw Form 15CA link against the form uploaded to withdraw the uploaded form 15CA. Following confirmation page will appear:

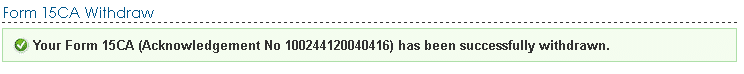

Step 5: Click on the “Click here to agree for withdrawal of Form 15CA” and then click on “Confirm withdrawal” button. Success message will be displayed on screen as shown below:

Step 5: Click on the “Click here to agree for withdrawal of Form 15CA” and then click on “Confirm withdrawal” button. Success message will be displayed on screen as shown below:

Step 6: When you check the status of the form, it will be changed to Form 15CA withdrawn.

Step 6: When you check the status of the form, it will be changed to Form 15CA withdrawn.

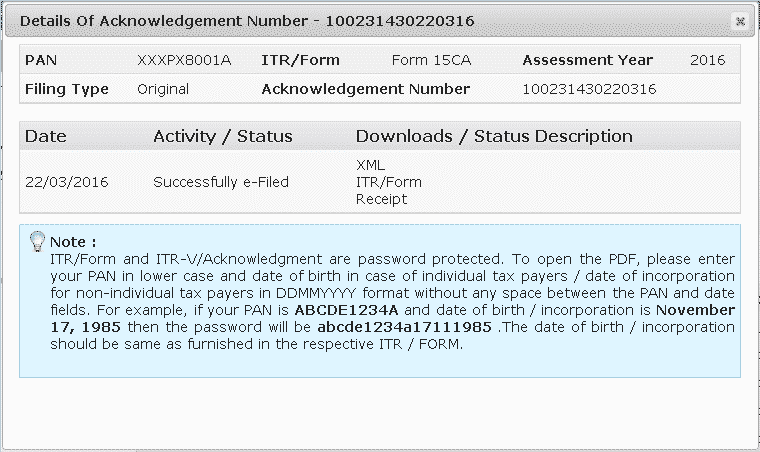

Step 7: Now to view the details of the Form 15CA, click on Acknowledgement Number.

Step 8: The details of the acknowledgement number will be displayed as a popup. To view the details, you can download PDF, Receipt or XMl.

Step 8: The details of the acknowledgement number will be displayed as a popup. To view the details, you can download PDF, Receipt or XMl.

Pre-requisite for Form 15CB

If you want to file Form 15CB, you must add a CA. To add a CA, follow the following steps:

Step 1: Login to e-filing portal, Navigate to My account, then click on Add CA.

Step 2: Enter the Membership Number of CA

Step 3: Select Form 15CB as Form Name and click on Submit.

If the you add CA, CA can file Form 15CB on your behalf.

In order to file Form 15CB, CA must be registered as ‘Chartered Accountant’ in e-filing. If not registered , CA should follow following steps:

Step 1: Click the link Register Yourself in the homepage.

Step 2: Select ‘Chartered Accountants’ under Tax Professional and click on Continue

Step 3: Enter the mandatory details and complete the registration process.

Procedure to File Form 15CB

Step 1: Download the Form 15CB utility from the https://incometaxindiaefiling.gov.in/ under Downloads page and prepare the XMl file.

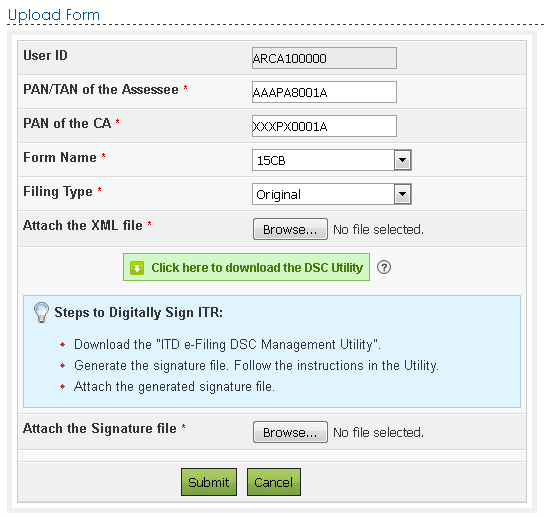

Step 2: Login to e-filing portal, Navigate to e-File, then click on Upload Form.

Enter the details required that are PAN/TAN of the assesse, PAN of the CA, Select the Form Name as 15CB and the filing type as Original.

Step 3: Upload the XML file generated from the utility downloaded under step 1. Upload the signature file generated using DSC management utility for the XMl file uploaded.

(Note: DSC is mandatory to file Form 15CB)

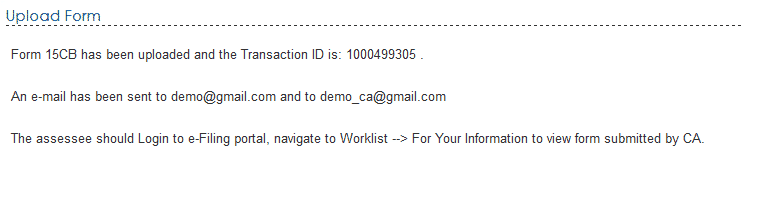

Step 4: On successful Validation, Form 15CB is uploaded in e-filing portal. Following success message will be displayed:

Procedure to View Form 15CB

When the CA has uploaded the Form 15CB, if assesse want to view uploaded Form 15CB, he has to follow the following steps:

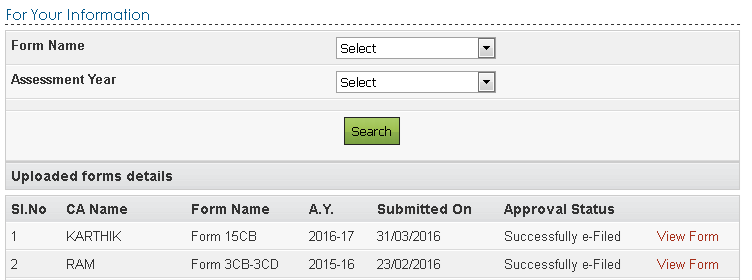

Step 1: Login to e-filing, Go to Worklist, then For your information.

Step 2: Form 15CB submitted by CA are displayed here.

Step 3: Click on “View Form” link to view the uploaded form by a CA. The status of the form shall be submitted.

Step 3: Click on “View Form” link to view the uploaded form by a CA. The status of the form shall be submitted.

On successful submission of Form 15CA- Part C against the Form 15CB, the status of the form shall be changed to ‘Consumed’.

In case the Form 15CA is withdrawn against which the Form 15CB was consumed, the status of the form shall be changed from ‘Consumed’ to ‘Withdrawn’.

One Form 15CB can be consumed only for one Form 15CA.

Step 4: Click on ‘Click here to view the uploaded Form 15CB’ to download the Form in pdf format.

Step 4: Click on ‘Click here to view the uploaded Form 15CB’ to download the Form in pdf format.

About the Author

Arpit Goyal is pursuing CA and B.com & also working as an article assistant in Gurgaon. He has an immense interest in Taxation. He loves to use technology to spread knowledge about taxation & accounts.

Arpit Goyal is pursuing CA and B.com & also working as an article assistant in Gurgaon. He has an immense interest in Taxation. He loves to use technology to spread knowledge about taxation & accounts.

Dear Sir,

How to open or avail the utility? You’ve mentioned download the utility and prepare the XML file but how to prepare a XML file? pls instruct me.

Thanks,

Milan Vora

THANK SOO MUCH VERY HELPFUL

Thanks Sonam for appreciation. Please share it with your friends.

Dear Arpit Goyal,

The subject of this message has nothing to do with the procedure for filing Form 15CA you have explained so well. I am a retired person. Spent the first 18 years of my life at sea as a marine engineer and the last 25 years stationed in the shore office of a shipping company in the middle east. Basically I have been a NRI for greater part of my life. I have now relocated to my hometown which is Kolkata. What I am looking for is guidance on transition from NRI status to that of a Resident. Believe there is a provision for a RNOR status for a few years. Can you please guide me on this subject? Thanking you in advance.

Best Regards, M. Zaffar Javed