The Government of India has been constantly working hard to ensure that online transactions can become more secured and private. One of the recent addition to the list is the e–Filing Vault system, a modern day mechanism which allows a tax payer to link his/ her e-filing account with other private accounts and convert the account into a more compact and secured portal.

What is e-Filing Vault?

- As part of the e-filing vault, you’ll receive an additional layer of protection for your account, making it necessary for you to double-check your account login information in addition to the normal login process.

- As a dual-factor authentication feature, e-Filing Vaults provide a secure way to login to your account.

- It is usually the case that the user ID (PAN) and password are required to log in through the e-filing portal in order to access the portal.

- As part of the e-filing vault, an additional layer of security is added to your account which requires an additional check beyond the normal login process in order to make sure that there is no malicious activity going on.

How to get e-Filing Vault in your e-Filing Account?

If you are looking forward to getting an e-filing vault feature in your account, then you can easily do the same by following the given steps:

Step 1- Log in to your e-filing account

The first thing that you are required to do is visit the website where your e-filing account is present. Once the page loads, insert your designated ID and password to log in and reach your profile page.

Step 2- Select the e-filing Vault option

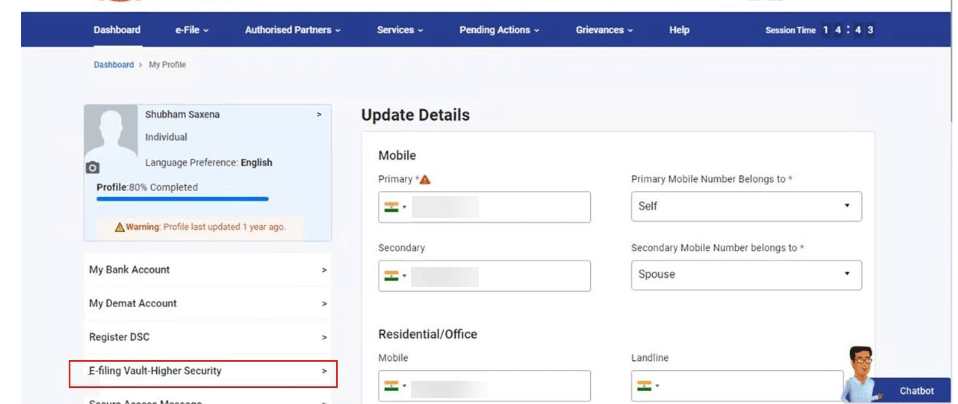

After making a successful log in, the user needs to navigate to their profile page. On reaching the page, there they will see an option which says Dashboard -> My Profile. On the profile page click on the “e-Filing Vault Higher Security” Option.

Step 3- Choose your option

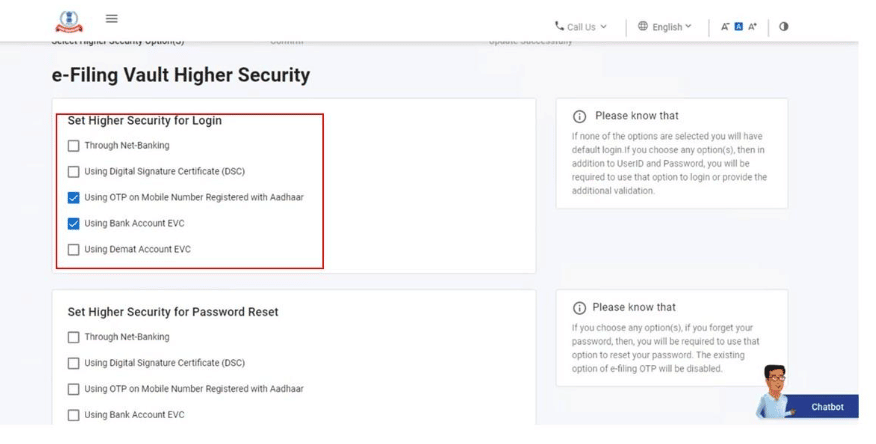

Upon clicking on the link, a new set of options will appear which will ask the user to choose one of the following option:

1) Login through Net Banking Access: Users should have logged in to e-filing portal through net banking at least once to avail this option

2) Login through DSC: Users need to register Digital Signature Certificate before opting for ‘Login Using DSC’. To register DSC, Go to My Profile -> Register Digital Signature Certificate.

3) Login through Aadhaar OTP: Users need to link Aadhaar to the PAN before opting for ‘Login using Aadhaar OTP’. To link Aadhaar, Go to My Profile -> Link Aadhaar

4) Login using Bank Account EVC: Users need to link Bank Account to the PAN before opting for ‘Login Using Bank Account EVC’. To Link Bank Account, Go to My Profile -> Pre validate your bank account

5) Login using Demat Account EVC: Users need to link Demat Account to the PAN before opting for ‘Login Using Demat Account EVC’. To Link Bank Account, Go to My Profile -> Pre validate your Demat Account.

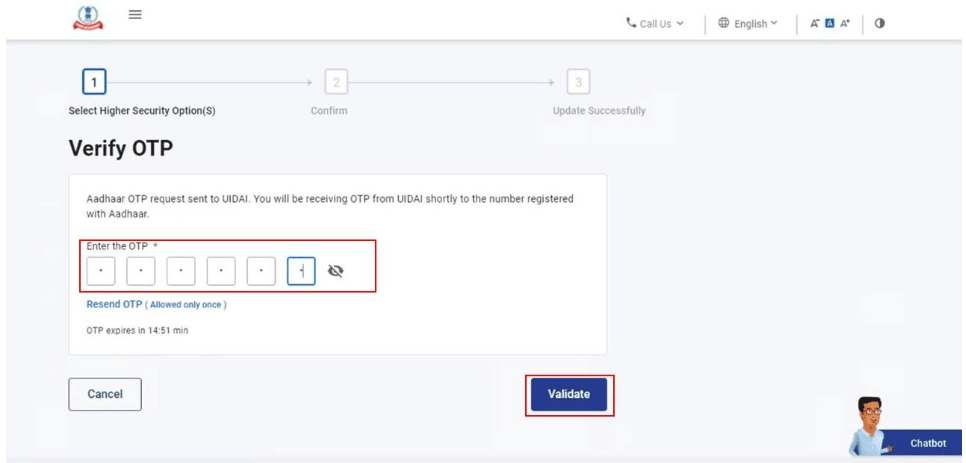

After selecting any of the above options, you have to generate OTP and verified it. That’it.

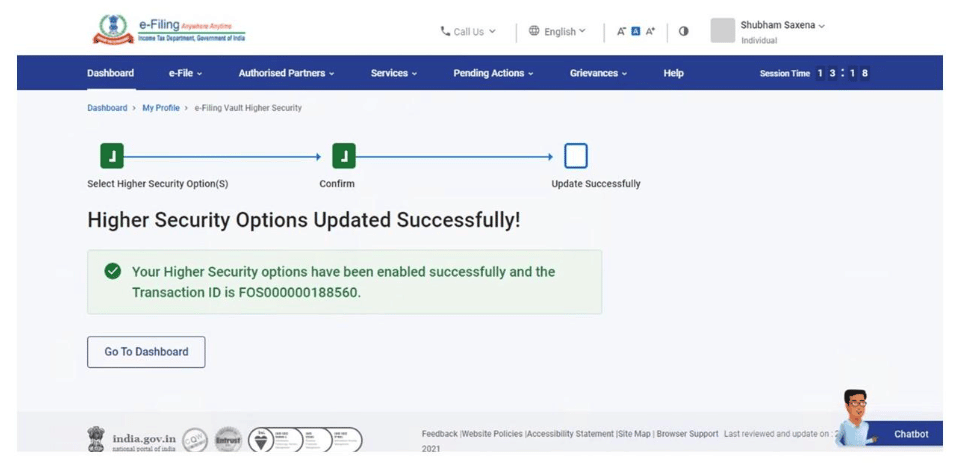

The user is free to choose any one of the above mentioned option. However, he has to remember the given access and ensure that he has linked that medium to his respective account before opting. In just 3 simple steps, the e-Filing Vault option can be activated on any e-filing account. The step has been carefully taken to promote the privacy of the users while filing returns and to make the overall system less complicated. Earlier, middlemen could easily access the account of the clients while e-filing and as a result, privacy was a concern for taxpayers. However, this time around the Government has ensured that the overall access of the e-filing account remains vested with every individual taxpayer and operations are more on a personal level.

Notes

Net Banking and DSC: In case of Net Banking option, the user simply needs to login in to the e-Filing account through his Net Banking access atleast once. For login using DSC, the user first needs to select the Digital Signature by going to My Profile and then selecting the option of Register Digital Signature Certificate. In the third option, the account holder needs to link the Aadhaar with the PAN card before applying to the option. Once the linking part is over, user can link his Aadhaar card by going to My Profile and selecting the option to Link Aadhaar with this respective account.

For the purpose of the e-Filing Vault option with Net Banking, there are only certain banks that have been permitted by the Government. Some of them are- SBI, Bank of India, Union Bank of India, Andhra Bank, Punjab National Bank, Corporation Bank, and IDBI Bank Ltd. And Bank of India.

Complete Guide of e-Filing Vault – Higher Security Official Guide by Income Tax Department – Visit Here