First of all you should know that ‘is it mandatory to deposit income tax online or not?’ and there are lots questions in your mind. We’ll try to cover all of your questions to solve like how to pay income tax online, how to pay income tax offline, how to fill tax Challan and how to deposit Challans in banks.

Table of contents

- Who is Required to Pay Income Tax Online?

- Which Way I will use to deposit income tax online?

- Which bank Offer e-payment of taxes facility?

- Detail Procedure to Pay Income Tax Online

- How to verify that my payment is credited to my account?

- How to deposit Self Assessment Tax or Advance tax to the credit of Government?

- What is the timing of E-Payment of taxes?

- What should I do if my bank does not have an online payment facility or is not an authorized bank for etax ?

- If after entering challan details in NSDL site if Bank Name is not being displayed what should I do?

- Account get debited more than once for the same e-tax transaction what should I do?

- When do I have to pay the taxes on my income?

- Contact Numbers & Emails of Banks

- Contact Numbers & Emails of NSDL

- Download Income Tax Challan Forms

Who is Required to Pay Income Tax Online?

The following persons are required to pay income tax online.

Can I deposit tax payment from another bank account?

Yes, you can deposit online income tax from the account of any other person or your own account. There is no restrictions like that. But you must enter the PAN of the person on whose behalf the payment is made. (CBDT Circular No.5/2008, dt.14-7-2008)

Which Way I will use to deposit income tax online?

You can deposit income tax online by making payment through internet banking facility(required user id and password of your bank) and by credit/debit cards.

Which bank Offer e-payment of taxes facility?

There are lots of nationalized and private banks offers e-banking facility. You can contact bank manager to opt for e-payment facility which require user id and password. Some of the following banks offer e-payment facility.

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Jammu & Kashmir Bank

- Oriental Bank of Commerce

- Punjab and Sind Bank

- Punjab National Bank

- State Bank of India

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

Detail Procedure to Pay Income Tax Online

Step 1

Visit this link https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Step 2

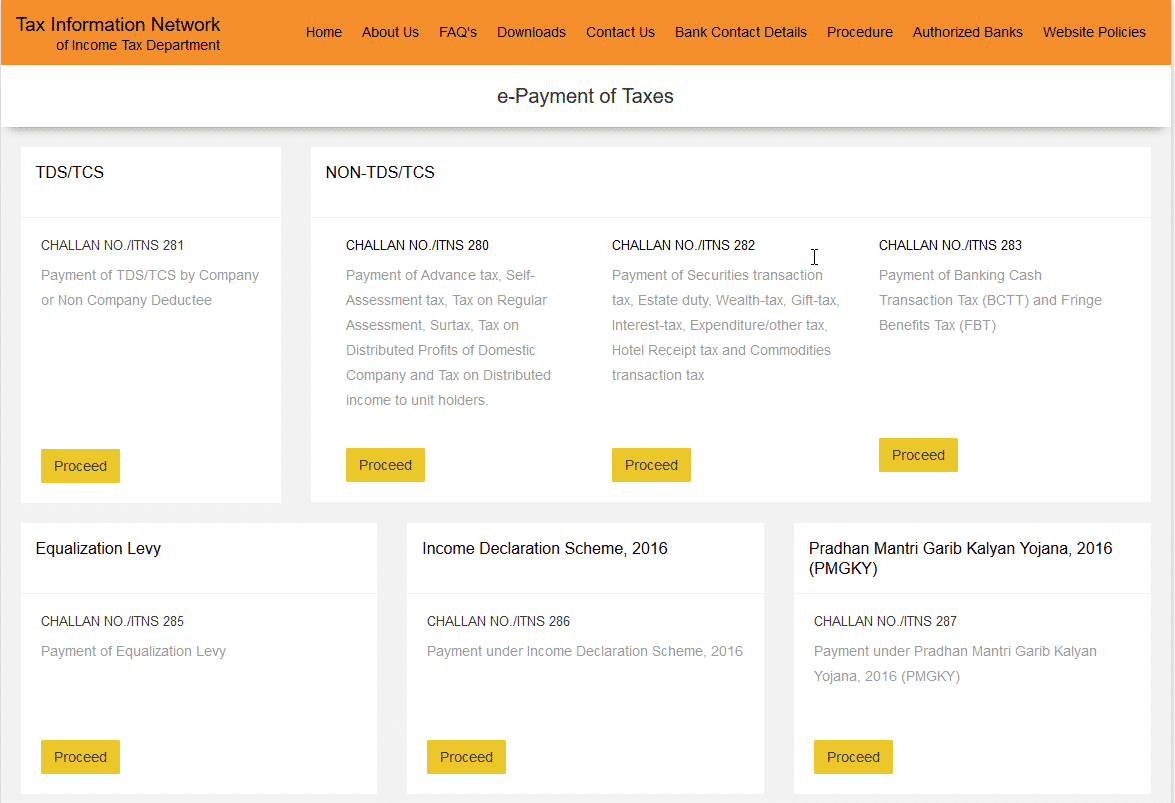

It will redirect you at https://onlineservices.tin.nsdl.com/etaxnew/tdsnontds.jsp. Click on applicable challan out of the following

- Income & coproation tax – Challan No./ITNS 280

- TDS/TCS – Challan No.281

- Securities Transaction Tax, Wealth Tax, Hotel Receipts Tax, Expenditure Tax/ Other Direct Tax – Challan No.282

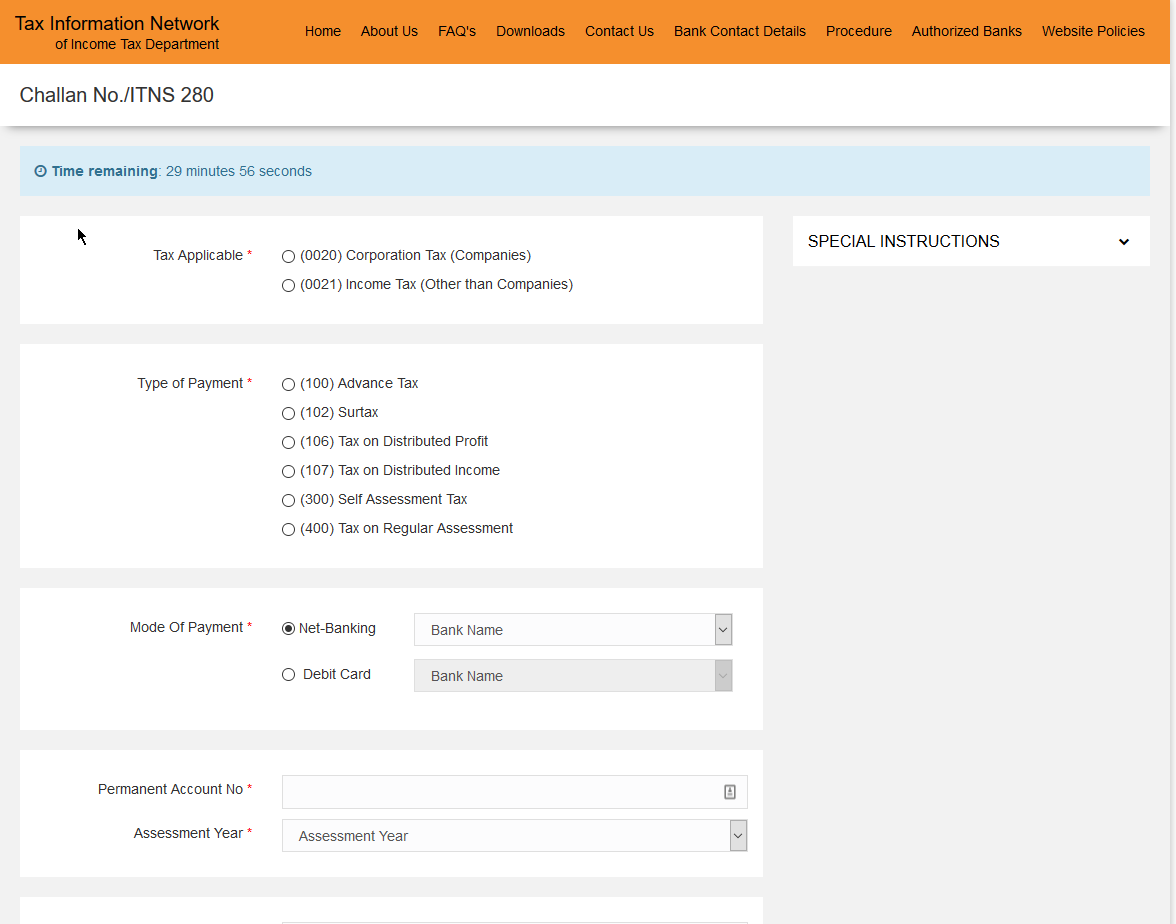

Step 3

Clicking on the applicable challan, the relevant challan’s screen will be shown. Now you have to fill the challan detail like PAN, Name, Address, Assessment year, type of payment etc. NSDL will credit our payment as per information we have filed. So ensure that correct PAN is entered. Otherwise it will credit to other account and you can not get refund of your tax.

Step4

Once all details entered and verified. Click on ‘Submit’ button. It will redirect to your net banking website.

Step5

Enter User ID and password given by the bank. It will redirect you on authorization page of e-payment gateway of taxes. All banks has its different procedure, layout of page and display.

Step 6

Enter the amount of tax to be paid with other detail like education cess, interest, penalty etc.

Step 7

Click to proceed or submit. The bank will begin to pay the taxes and debiting the bank. After competing the process it will be displayed the payment detail like CIN, tax amount, bank name, BSR code. All information must be printed and kept with you for future reference.

Challan Identification Number(CIN) must be needed in Income Tax Return. Otherwise you can not claim refund or claim that you have paid your due taxes. So it is very important document to keep with you.

See: Document prepared in support of income tax return.

How to verify that my payment is credited to my account?

You can verify your payment by going to NSDL TIN website in the ‘Challan Status Inquiry’. But it will take time to shown for 5 to 7 days.

Note: If encountered any error on e-tax website kindly contact TIN call centre at 020 – 27218080 or write to us at [email protected] (Please indicate the subject of the mail as Online Payment of Direct Tax ).

How to deposit Self Assessment Tax or Advance tax to the credit of Government?

Self Assessment Tax or Advance Tax is to be deposited to the credit of Government by using the challan prescribed in this behalf, i.e., ITNS 280. The Challan can be downloaded from www.incometaxindia.gov.in Tax can be paid in the designated banks through two modes, viz., physical mode, i.e., cash/cheque or e-payment mode by using debit card or internet banking. In case you are not able to download challan after the e-payment, then challan details will be updated in your Form 26AS after few days.

What is the timing of E-Payment of taxes?

All direct taxes can be deposited any time (24X7) electronically (E-payment mode) by using internet banking or debit card.

In case your bank does not have an online payment facility or is not an authorized bank then you can make electronic payment of tax from the account of any other person who has an account with the authorized bank having online facility. However, the challan for making such payment must clearly indicate your Permanent Account Number (PAN).

If after entering challan details in NSDL site if Bank Name is not being displayed what should I do?

The problem may be encountered because of the following

Reason 1: If Assessee enters incorrect TAN / PAN in challan data entry screen.

Reason 2: If Assessee using Internet Explorer browser then temporary internet files should be deleted by following

Open Internet Explorer window

Go to “Tools” Menu

Select “Internet Options”

Delete cookies and Delete temporary Internet files on your machine

Close the current Internet Explorer windows

Again go to tin-nsdl site & make e-payment

Account get debited more than once for the same e-tax transaction what should I do?

If during the transaction or after completing the transaction bank site encountered any error or get disconnected before generating Taxpayer counterfoil then instead of doing the same transaction again kindly check your Account, if account has been debited then contact your bank for the taxpayer’s counterfoil. Please note in the above case do not make the same transaction again which will result in account being debited more than once for the same e-tax transaction.

When do I have to pay the taxes on my income?

The taxes on income can be finalized only on the completion of the previous year. However, to enable a regular flow of funds and for easing the process of collection of taxes, Income-tax Act has provisions for payment of taxes in advance during the year of earning itself or before completion of previous year. It is also known as Pay as your earn concept.

Taxes are collected by the Government through the following means:

Voluntary payment by taxpayers into various designated Banks such as Advance tax, Self-Assessment tax, etc.

Taxes deducted at source

Taxes collected at source

Contact Numbers & Emails of Banks

[table “87” not found /]

Contact Numbers & Emails of NSDL

Head Office

Mumbai: Address Times Tower, 1st Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai, Maharashtra, PIN – 400013.

PAN/TDS Call Centre of Tax Information Network (TIN) managed by NSDL

- Address: 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997 /8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

- Telephone: 020 – 27218080 (From 7.00 AM to 11.00 PM For All Days)

- Email: [email protected]

- Tracking of application status is available through IVR between 11:00PM and 7:00AM after Call Centre timing.

Branch Offices

New Delhi

- Address: 409/410, Ashoka Estate Building, 4th floor, Barakhamba Road, Connaught Place, New Delhi 110 001.

- Telephone: (011) 2370 5418 / 2335 3817

Chennai

- Address: 6A, 6th Floor, Kences Towers, #1 Ramkrishna Street, North Usman Road, T. Nagar, Chennai – 600 017

- Telephone: (044) 2814 3917/18

Kolkata

- Address: 5th Floor, The Millenium, Flat No. 5W, 235/2A, Acharya Jagdish Chandra Bose Road, Kolkata – 700 020

- Telephone: (033) 2281 4661 / 2290 1396

Ahmedabad

- Address: Unit No. 407, 4th floor, 3rd Eye One Commercial Complex Co-op. Soc. Ltd., C. G. Road, Near Panchvati Circle, Ahmedabad, Gujarat– 380006

- Telephone: (079) 2646 1376

Aaykar Sampark Kendra

- Telephone: 1800-180-1961

- email: [email protected]

Download Income Tax Challan Forms

| 237 | Challan 280 | Payment of Income Tax (Corporate / Non Corporate) | Download |

| 238 | Challan 281 | Payment of TDS / TCS (Corporate / Non Corporate) | Download |

| 239 | Challan 282 | Payment of SECURITIES TRANSACTION TAX / HOTEL RECEIPTS TAX / ESTATE DUTY / INTEREST TAX / WEALTH TAX / EXPENDITURE/OTHER TAX / GIFT TAX | Download |

| 240 | Challan 283 | Payment of BANKING CASH TRANSACTION TAX / FRINGE BENEFITS TAX | Download |

Download all Income Tax Forms in PDF Format