Income Tax Login: Income Tax Portal Registration for Easy ITR Filing: Is filing your income tax returns every year a hassle for you? The new income tax portal offers a seamless experience that makes filing your ITR a breeze. A user-friendly interface, faster processing times, and a variety of services make tax compliance easier with the new portal. To take advantage of these benefits, you must register on the platform. With this step-by-step guide, we’ll show you how to register on the new income tax portal, so you can file your ITR easily and remain compliant. To make ITR filing stress-free, read on to learn how to register on the new income tax portal.

How to register on incometax.gov.in?

It is very simple to register on the website of Income Tax India for the purposes of e-filing. To give you a quick step-by-step guide on how to do it, here are the steps:

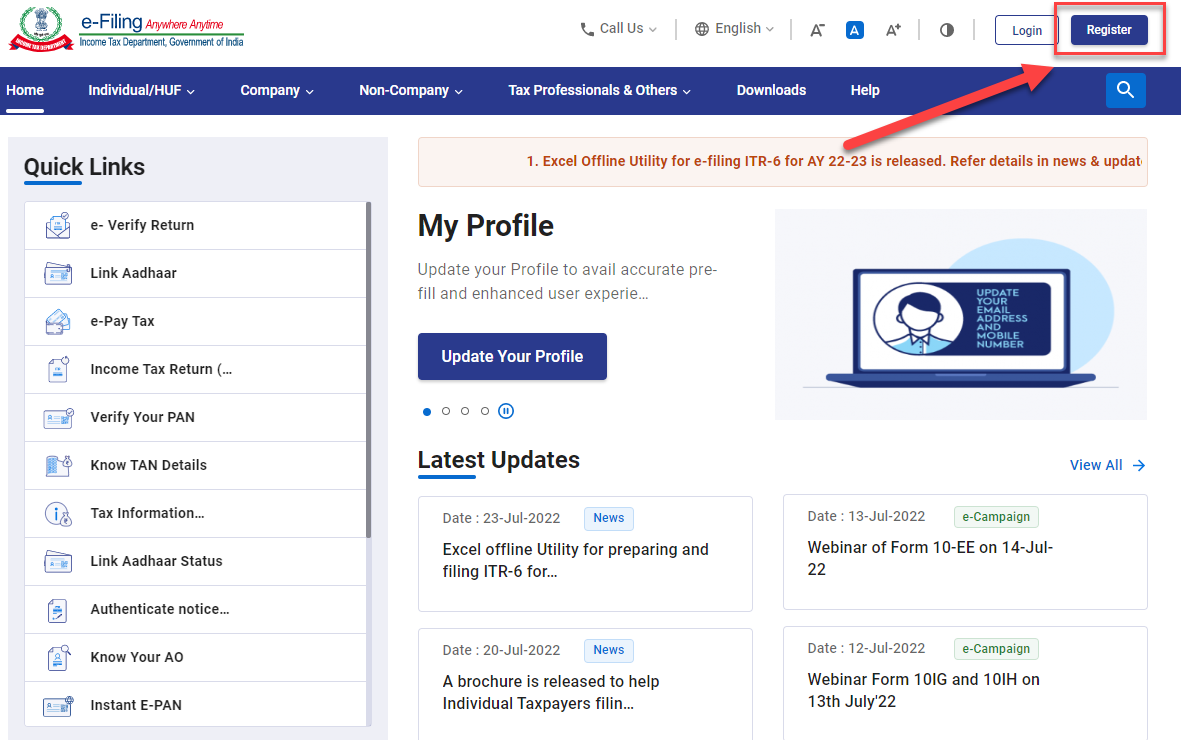

Step 1: Visit the website: https://www.incometax.gov.in/iec/foportal – Direct Link Here

Step 2: The top right-hand side of the website will have a list of options available once the site is open. The second blue tab is called “Register“. When you click on it, you will be taken to another page as soon as you click on it.

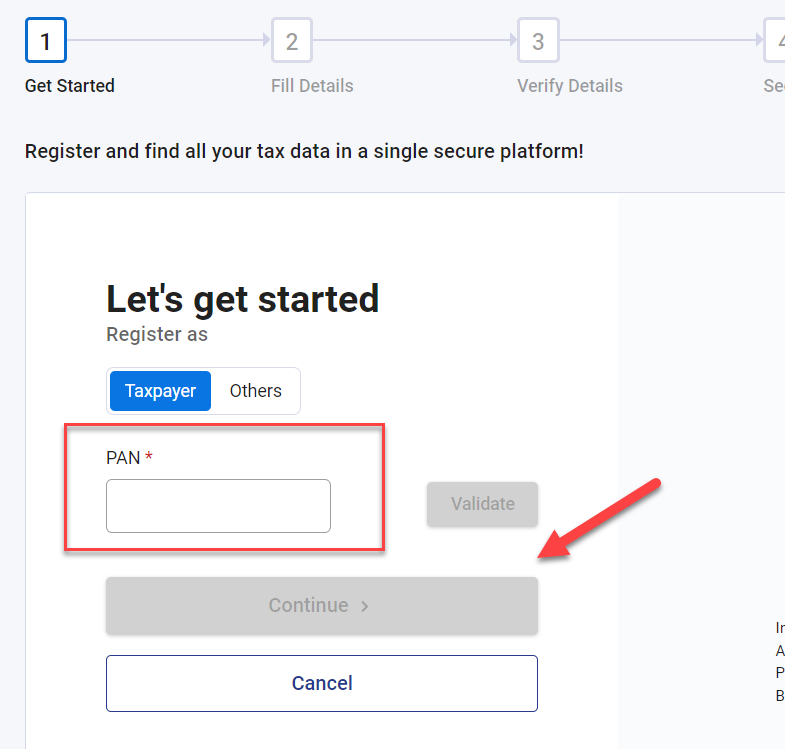

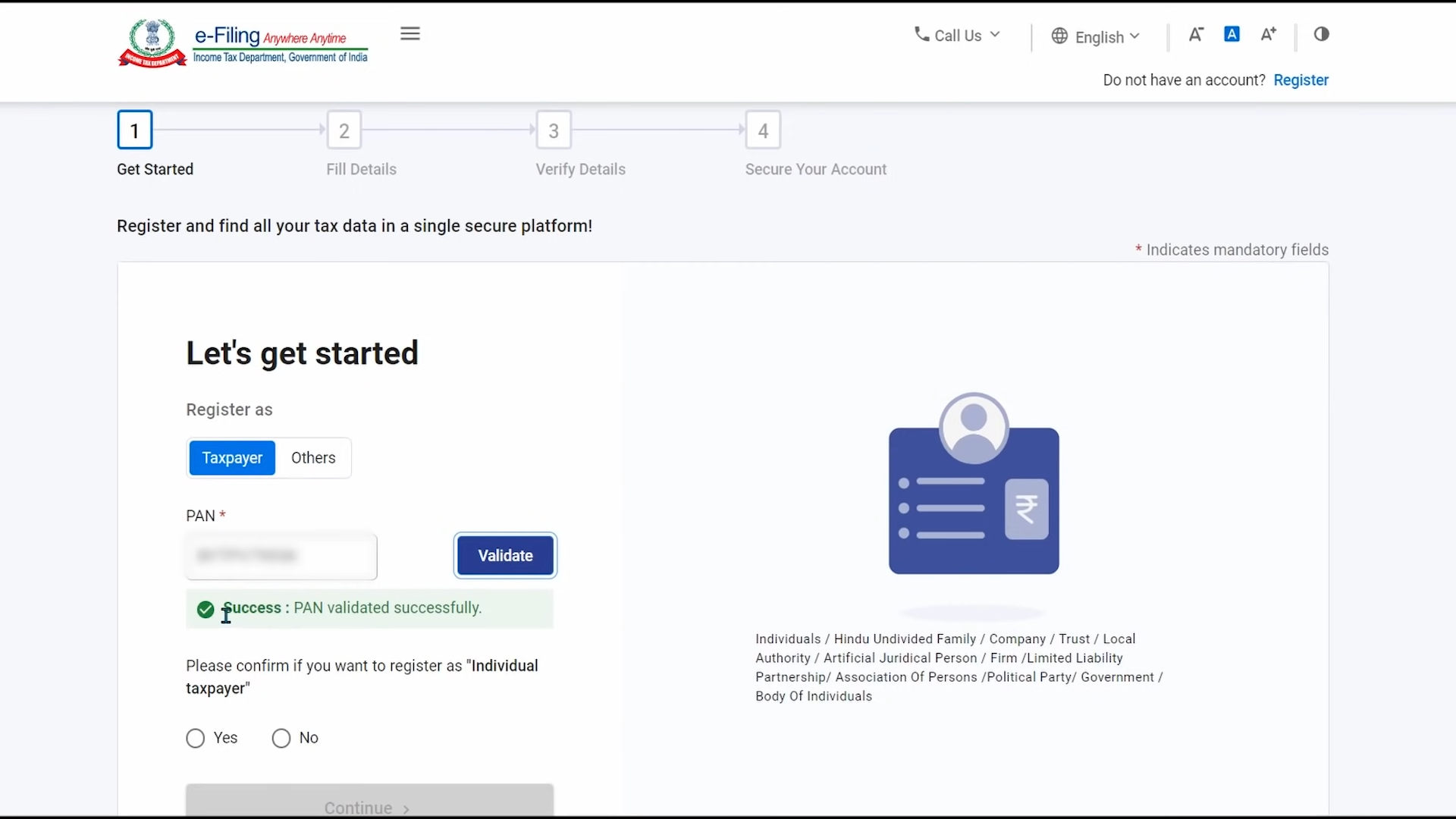

Step 3: This is the 3rd step to register yourself on incometax.gov.in. A new page will appear with a list of options. Here you would be required to enter your PAN, validate and after validation click on the continue button.

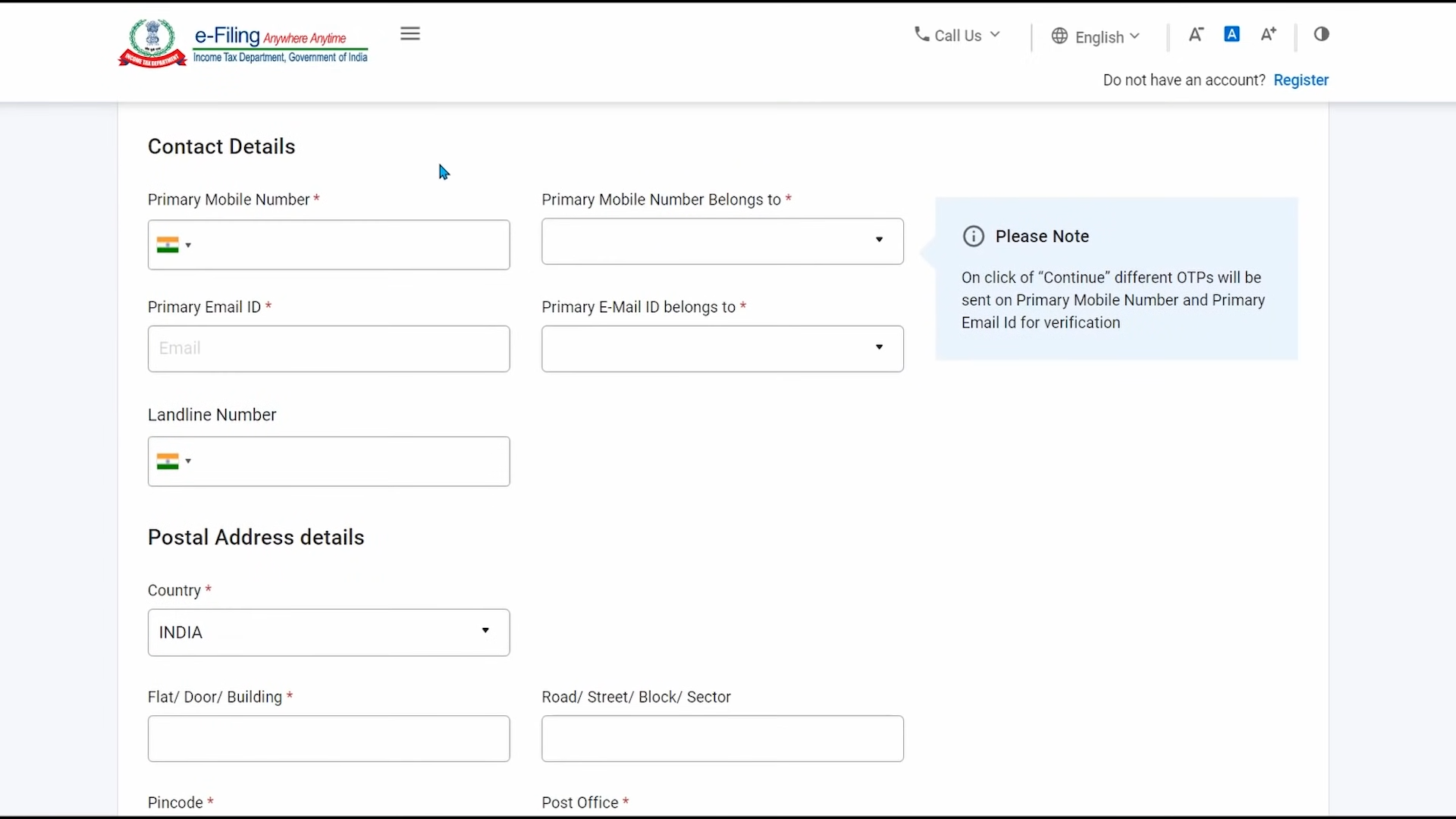

Step 4: Now, you will be required to enter all the mandatory information provided on the Basic Details page, including your name, DOB / DOI, gender (if applicable) and your residential status as per your PAN. Once you have completed this, click Continue. Now, we will move to the next step to register on incometax.gov.in.

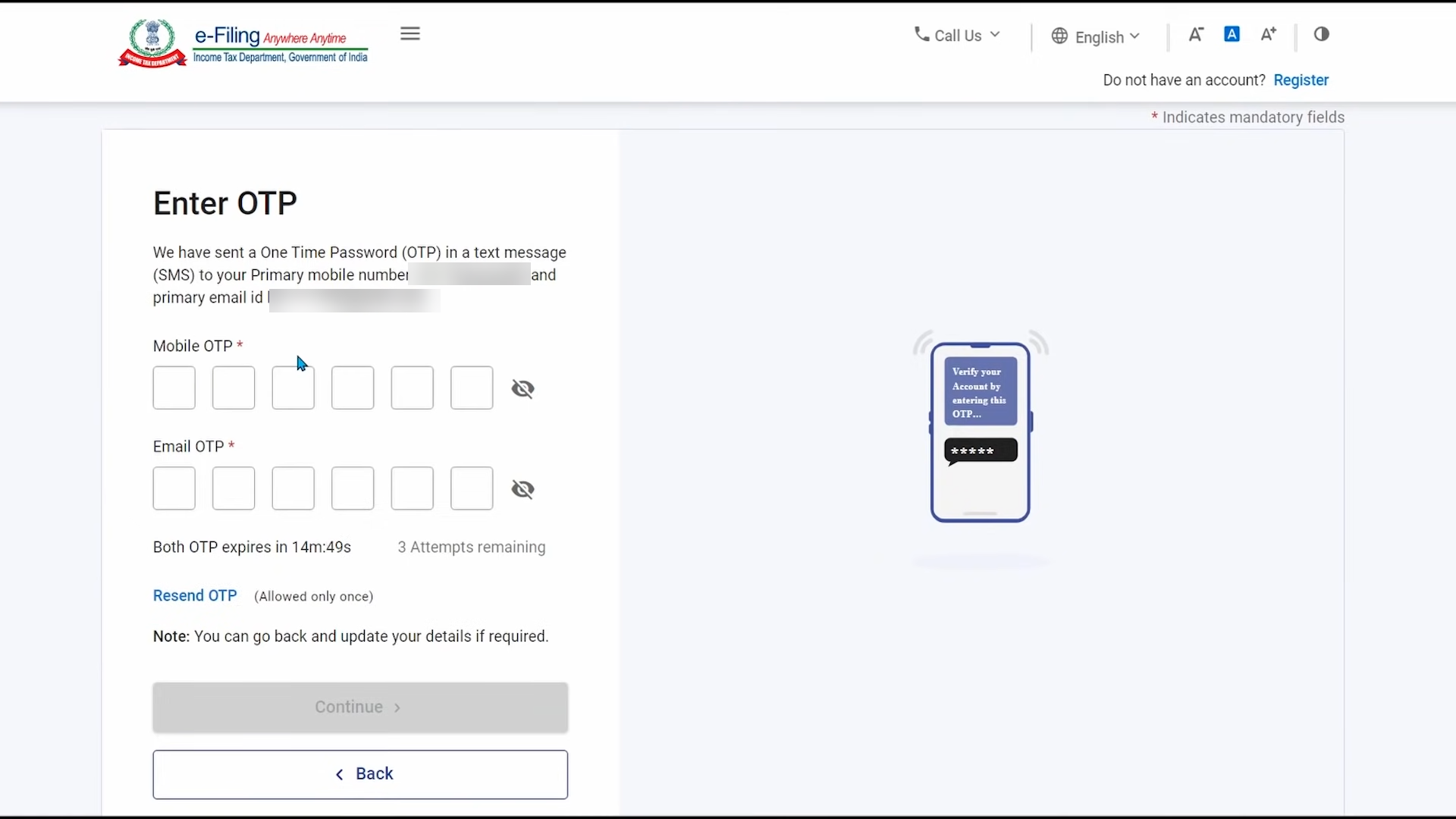

Step 5: After submitting the basic information, you will be required to enter OTP received on your mobile number and email ID.

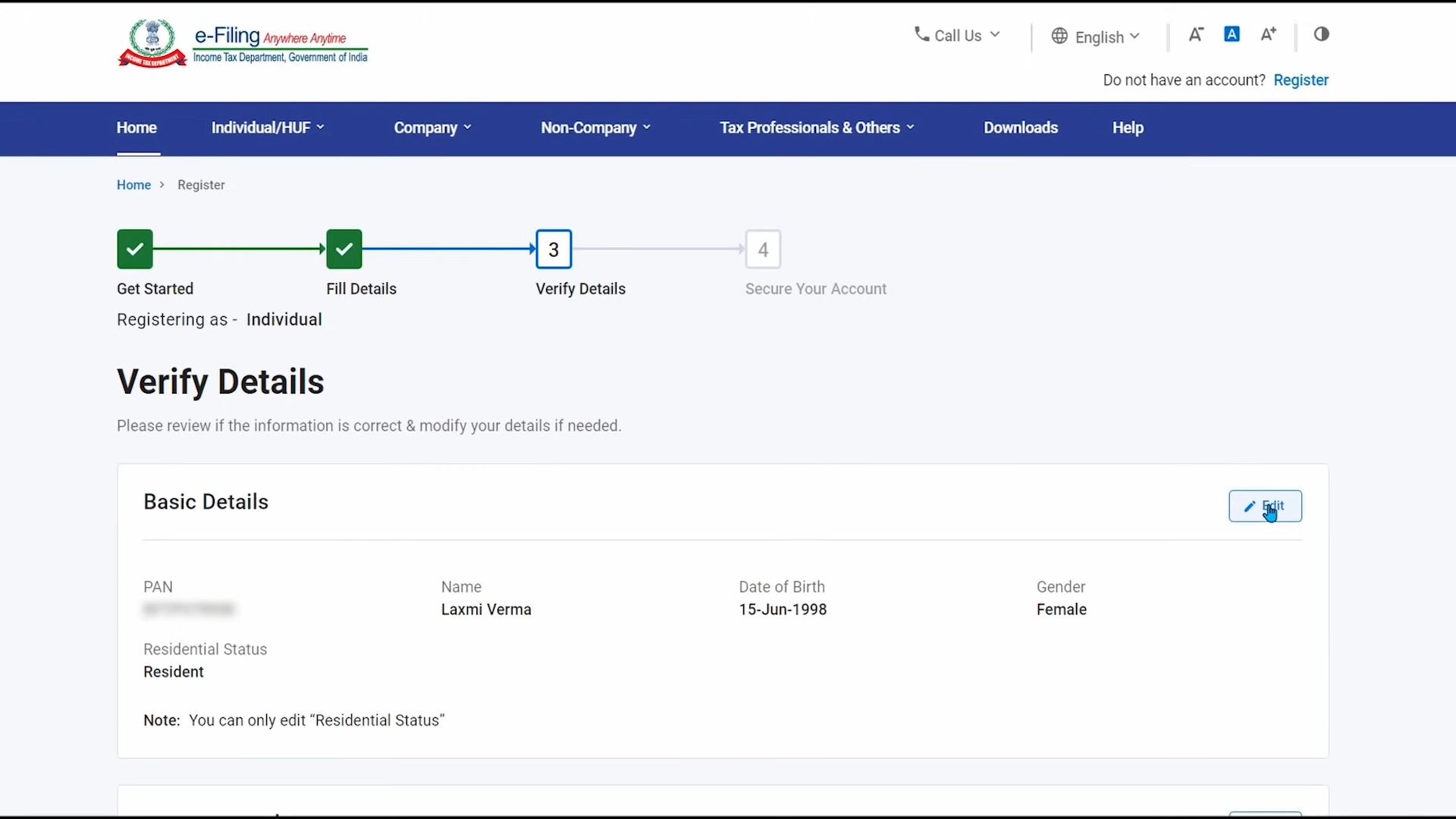

Step 6: After entering OTP, click on continue. Now you will reach on the “Verify Details” page. Here you should verify all your entered information. If you found any mistakes you can edit and enter again the correct information. After verifying all the detail, you should click to “Confirm” button.

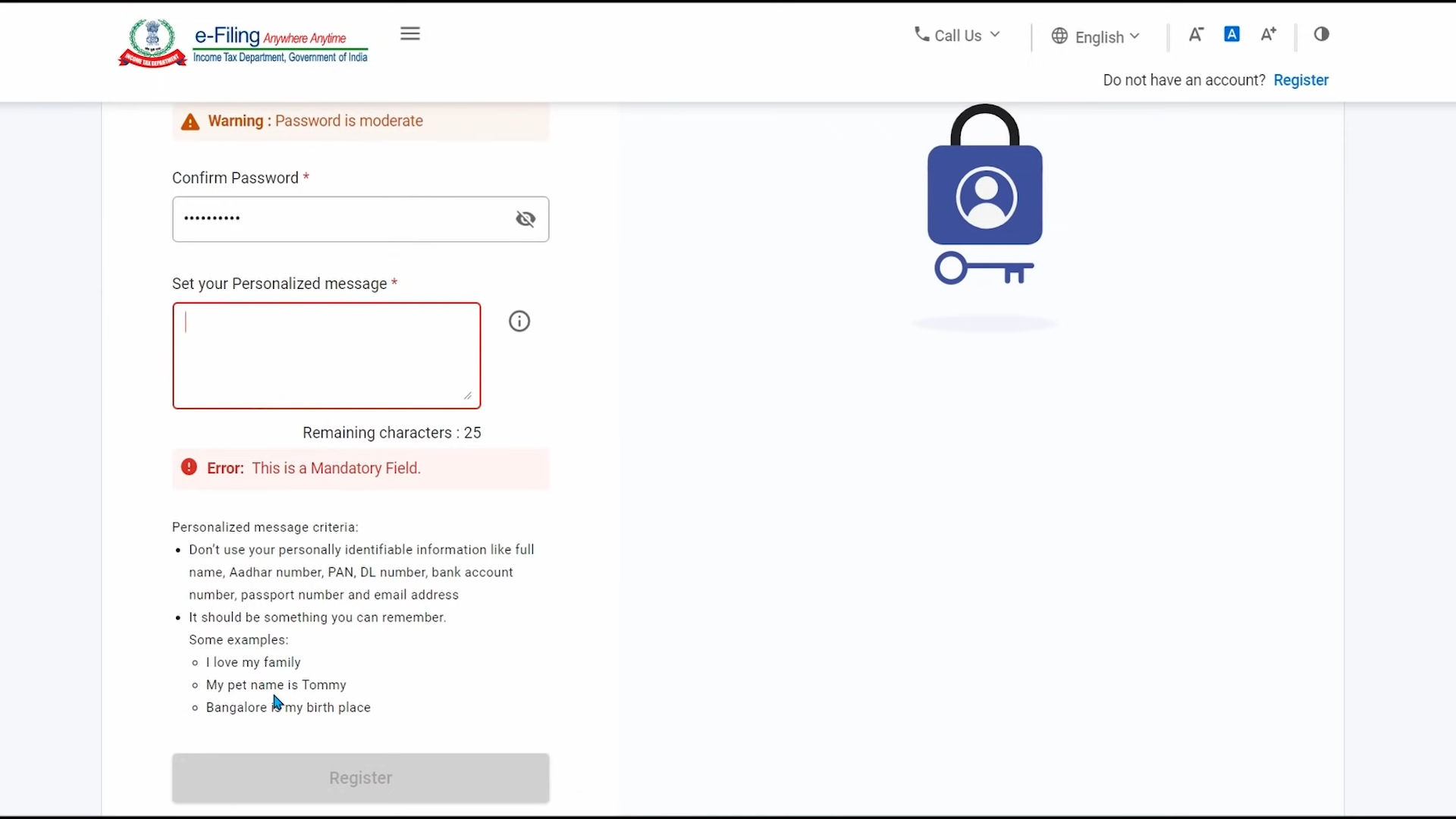

Step 6: Now, this is the last step to register on incometax.gov.in. Here we will secure our account by setting the password of your account. Don’t forget to enter “Set your personalized message”. Now click on the “Register” button. That’s it!

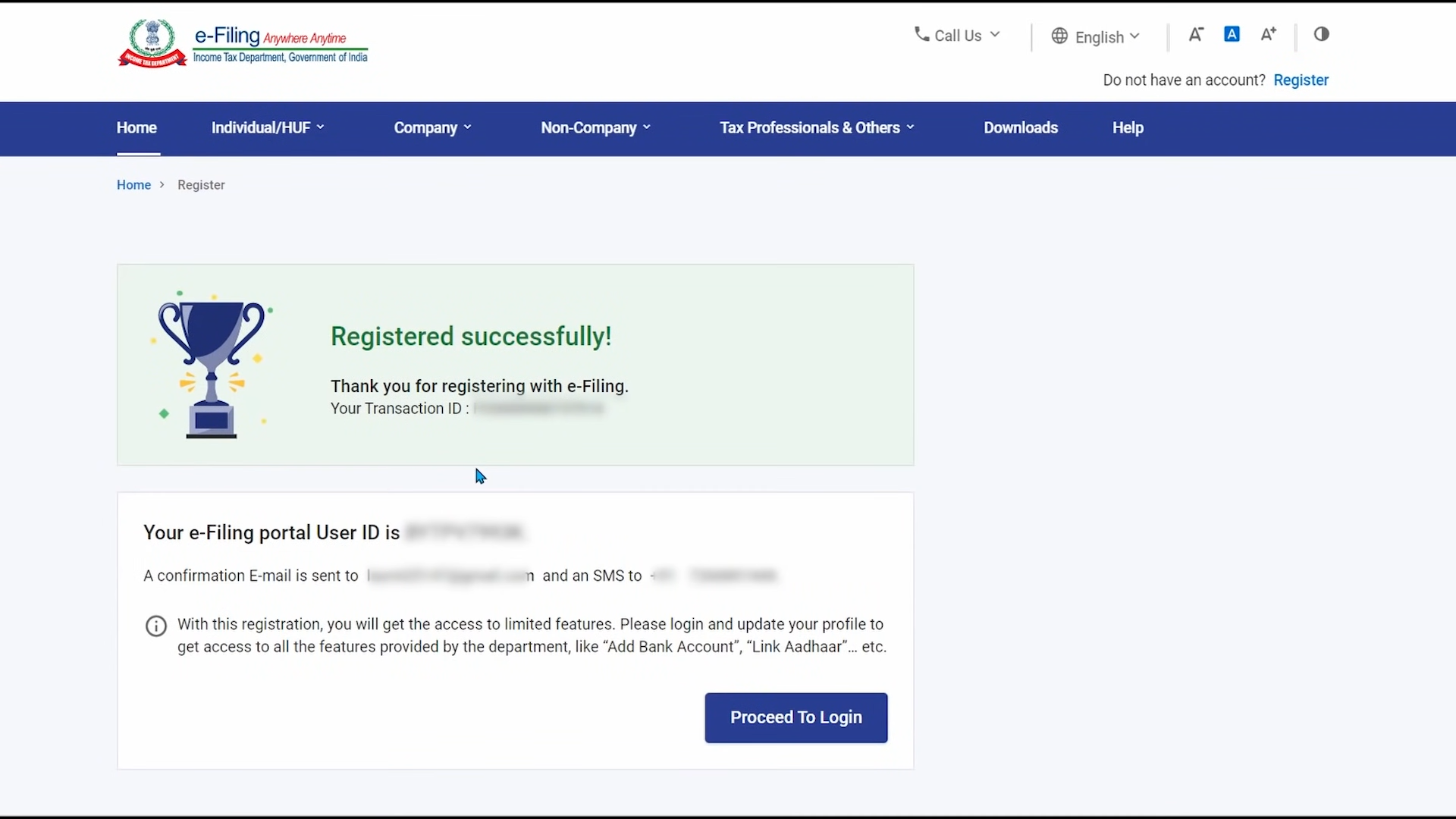

After successful registration, you will see the “Registered Successfully!”. You will also get messages on your mobile and email ID.

How to Do Login on to incometax.gov.in?

If you are a registered user on the Income Tax India e-Filing website then it is obvious that you would have a User ID and Password. Here is the step-by-step login process-

Step 1: Visit the website: https://www.incometax.gov.in/iec/foportal – Direct Link Here

Step 2: Once the website is opened right in front of you, look at the list present at the top right-hand side of the page. The first yellow tab is named as “Login Here”. Click on it.

Step 3: A new page will appear where you would be required to enter your registered User ID and Password along with the displayed captcha. Once done, click on the ‘Login’ button.

Step 4: Upon successful login, you would be able to see your dashboard.

Link PAN with Aadhaar on Income Tax Portal

After you have registered on the new income tax portal, the next step is to link your PAN with Aadhaar. Here’s how:

1. Visit the new income tax portal to access your account.

2. Click ‘Profile Settings’ on the dashboard.

3. Select the ‘Link Aadhaar’ option from the drop-down menu.

4. Click ‘Continue’ after entering your Aadhaar number.

5. An OTP will be sent to your registered mobile number and email address. Click ‘Continue’ after entering the OTP.

6. As soon as your PAN is linked with Aadhaar, you will receive a confirmation message on your mobile phone and email address.

Forget Password? How to Login on Income Tax Portal

If you do not remember your User ID or Password at the time of login, click on the ‘Forgot Password’ option. It is present just beside the “Login” button. Upon clicking you would be required to enter your User ID and enter the given captcha. An OTP would be sent to the registered mobile number. Enter the OTP on the website and you will get the option to reset your password.

Income Tax Login: Income Tax Portal Registration for Easy ITR Filing: Is filing your income tax returns every year a hassle for you? The new income tax portal offers a seamless experience that makes filing your ITR a breeze. A user-friendly interface, faster processing times, and a variety of services make tax compliance easier with the new portal. To take advantage of these benefits, you must register on the platform. With this step-by-step guide, we’ll show you how to register on the new income tax portal, so you can file your ITR easily and remain compliant. To make ITR filing stress-free, read on to learn how to register on the new income tax portal.

Benefits of Registration on the Income Tax Portal

Here are some of the benefits of registering on the new income tax portal before we dive into the registration process:

- Faster processing times: As a result of the new portal, your ITR will be processed more quickly, which means you’ll receive your refund more quickly as well.

- User-friendly interface: Users can navigate and file their ITRs easily with the new portal, which is designed to be user-friendly.

- Mobile-friendly: With the mobile-friendly portal, you can file your ITR from your smartphone or tablet. It is recommended to use a laptop or desktop to file your income tax return in order to have a better user experience.

- Additional services: In addition to tax calculators, e-verification, and more, the new portal simplifies tax compliance.

Also Read: Who Should file Income Tax Return (A.Y.2023-24)

In addition to faster processing times, a user-friendly interface, and additional services to make tax compliance easier, the updated income tax portal (incometax.gov.in) offers several advantages over the old one. In addition to being mobile-friendly, the income tax portal allows taxpayers to file their ITR from smartphones or tablets.

Lastly, The income tax portal simplifies the ITR filing process. Register on the income tax portal and link your PAN to your Aadhaar to file your ITR quickly. Stay compliant with tax regulations by following this step-by-step guide. Take advantage of the new income tax portal and file your ITR easily.

I hope you found our detailed article on income tax portal registration and login helpful.

FAQ – Income Tax Portal Login and Registration

Q. What is the process for registering on the income tax portal?

- Visit this website: https://www.incometax.gov.in/iec/foportal

- Go to the “Register” tab.

- Please enter your PAN and validate it.

- You will need to fill in the mandatory details on the Basic Details page.

- Please enter the OTP you received on your mobile number and email address.

- Set your password after verifying the entered information.

- To complete the registration process, click the “Register” button.

Q. What is the website for income tax login?

The website for income tax login is https://www.incometax.gov.in/iec/foportal.

Q. What is the income tax portal login process?

- Please visit: https://www.incometax.gov.in/iec/foportal.

- Go to “Login Here” and click it.

- Please enter your User ID, Password, and captcha.

- Click on the “Login” button to access your dashboard.

Q. What is the process of linking my PAN with Aadhaar on the income tax website?

- Visit the income tax portal and log in to your account.

- On the dashboard, click “Profile Settings.”.

- From the drop-down menu, choose “Link Aadhaar.”.

- Please enter your Aadhaar number and click on the “Continue” button.

- Please enter the OTP you received on your mobile number and email address.

- You will receive a confirmation message once your PAN is linked with Aadhaar.

Q. What should I do if I forget my password for the income tax portal?

- You can reset your password by clicking on the “Forgot Password” link.

- Please enter your User ID and captcha.

- You will receive an OTP on the mobile number you registered.

- Reset your password by entering the OTP on the website.

Q. What are the benefits of registering on the income tax portal?

- Refunds and ITRs are processed more quickly.

- ITR filing made easy with an easy-to-use interface for easy navigation and filing of ITRs.

- ITR can be filed from a smartphone or a tablet using a mobile-friendly portal.

- E-verification and tax calculators.

Q. Can I file my income tax return from a mobile device?

You can file your ITR from your smartphone or tablet using the income tax portal. For a better user experience, use a laptop or desktop.

Q. Who should file an income tax return? Where can I find more information?

More information can be found in the article “Who Should File Income Tax Returns (A.Y.2023-24)”. Please read detailed article on “Who should file an income tax return?”

Q. Is it possible to register on the income tax portal without a PAN card?

In order to register on the income tax portal, you must have a PAN card. PAN cards are required for registration.

Q. If I encounter an error during registration, what should I do?

Make sure you have entered the correct details and followed the instructions correctly if you encounter an error during registration. You can contact the income tax helpline or customer support if the problem persists.

Q. Is it possible to change my registered email address and mobile number after registration?

It is possible to update your registered mobile number and email address after registration. Make the necessary changes in the profile settings section of the income tax portal.

Q. Does the income tax portal charge a fee for registration?

Registration on the income tax portal is free of charge. Creating an account and using the portal’s services are free.

Q. Can you tell me what documents I need to register on the income tax portal?

Your PAN card is the primary document required for registration. During the registration process, keep your PAN details handy, including your PAN number and date of birth. Please read detail article on “Essentials Documents Needed for Filing ITR“.

Q. Is it possible to access my previous year’s income tax returns through the portal?

You can access your previous year’s income tax returns and related documents once you log into the income tax portal. For your reference, the portal provides a history of your filed returns.

Q. Does the income tax portal require a specific browser?

Google Chrome, Mozilla Firefox, and Internet Explorer are all compatible with the income tax portal. A smooth experience can be achieved by using the latest version of your preferred browser.

Q. Is it possible to file income tax returns for multiple financial years through the portal?

Income tax returns can be filed for multiple financial years via the income tax portal. ITRs can be filed for any assessment year.

Q. Is it mandatory to link Aadhaar with PAN for filing income tax returns?

Yes, as per the income tax regulations, it is mandatory to link your Aadhaar with your PAN in order to file income tax returns. Make sure to complete the Aadhaar-PAN linkage process on the portal.

Q. How can I download my Form 26AS from the income tax portal?

After logging in to the income tax portal, you can access and download your Form 26AS, which contains details of tax deducted on your behalf. You can download Form 26AS from the dashboard or “View Form 26AS” section of the portal.

It is in point of fact a ice and helpful piece of info.

I am satisfied that you just shared this useful information with us.

Please keep us informed like this. Thqnks for sharing.

I LIKE IT VERY MUCH