TDS on Payment to Contractor (Sec 194C) (AY 2023-24): Any person who is paying any payment to any resident contractor for doing any work is responsible to deduct TDS on that payment. Tax is deductible under section 194C only if payment is made in pursuance of a contract between a specified person and resident contractor. You can check who are the specified person given below. In this article, we will discuss how to deduct TDS u/s 194C, how to deposit, how to file a TDS return, issue a TDS certificate and more.

Quick Summary

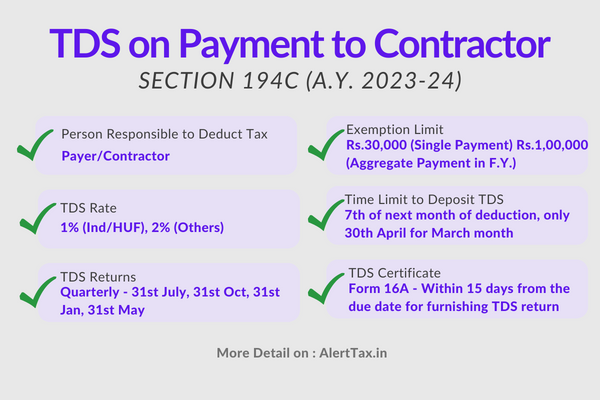

Table of Quick Summary for TDS on Payment to Contractor u/s 194C: Here is the quick summary for TDS on Payment to Contractor under section 194C for A.Y. 2023-24 F.Y. 2022-23. You should also read the complete article to understand the quick summary related to section 194C.

| Person Responsible to Deduct Tax | Specified person |

| Exemption Limit | Rs. 30,000 for a single payment or aggregate amount in the financial year does not exceed Rs. 1,00,000* |

| TDS Rates | 1% (If the recipient/payee is an Individual/HUF)

2% (If the recipient is any other person) |

| Time of Deduction of TDS | At the time of payment or credit whichever is earlier |

| Time for Deposit of TDS | Within one week from the last day of the month of tax deduction, For the month of March, before 30th April. |

| Certificate of TDS | Form 16A for each quarter is to be issued within 15 days from the due date for furnishing the statement of tax deducted at source under rule 31A i.e. on or before 15th August, 15th November, 15th February and 15th June |

| Quarterly Return of TDS | In Form No.26Q on or before 31st July, 31st October and 31st January for the first three quarters and on or before 31st May for the last quarter. |

| AO’s Certificate for Deduction at Lower Rate or Non-Deduction | Yes, Application in Form No. 13 Appropriate Certificate to be issued by AO |

| Is Self Declaration by Payee for Non-Deduction Admissible | No |

Specified Persons

Who are specified person u/s 194C for deducting TDS on Payment to Contractor (A.Y. 2023-24 F.Y. 2022-23): Tax is deductible under section 194C only if payment is made in pursuance of a contract between a specified person and resident contractor. The following are the specified persons for this purpose.

- Central Government or any State Government or

- Any Local Authority or

- Any Corporation by a Central or State or Provincial Act or

- Any Company

- Any co-operative society or

- Any authority constituted in India by or under any law engaged in housing accommodation or

- Any Society or

- Any Trust or

- Any University or

- Any Foreign Government or

- Any Firm or

- Any Individual/HUF/AOP/BOI if the amount paid or credited is not exclusively for the personal purposes (of an individual or any member of HUF) and if total sales, turnover or gross receipts from business or profession carried on him exceed Rs.1 crore in the case of business or Rs.50 lakh in the case of the profession during the financial year immediately preceding the financial year in which the income is to be credited or paid (applicable from April 1, 2020).

TDS Rates on Payment to Contractor

TDS Rates u/s 194C for payment to contractors: The person who is responsible to deduct TDS (as given above) under section 194C must deduct TDS for A.Y. 2023-24 F.Y. 2022-23 as per the rates given below.

- 1% (where the payment is being made or credit is given to an individual or a HUF)

- 2% (where the payment is being made or credit is to be given to any other entity)

- The rate will be NIL if the transporter quotes his PAN.

- TDS shall be deducted @ 20% in case a deductee fails to furnish his Pan to the deductor (Sec. 206AA)

- No surcharge, education cess and SHEC shall be added. Hence, TDS shall be deductible at a basic rate.

Time of Deduction

When tax has to be deducted on contract payments u/s 194C: The payer or specified persons will deduct TDS on payment to contractor for A.Y. 2023-24 F.Y. 2022-23 at the specified time given below.

- The payer will responsible to deduct TDS on contract payment at the time of payment or credit whichever is earlier.

- Payment should be more than Rs. 30,000/- for one contract/each contract or Rs.1,00,000/- (w.e.f. 1-6-2016) in total for all the contracts. The deduction will be made when the payment is credited or paid.

- When the amount exceeds Rs. 30,000 then the deduction will be made on the earlier amount also. Section 194 C is applicable for resident contractors only. For non-residents, section 195 will be applicable.

Time Limit to Deposit of TDS on Payment to Contractor

When to deposit TDS under section 194C (: As per rule 30, the following time limit will be applicable in respect of TDS deduction on contract payment under section 194C.

Where the due date of deposit of TDS falls between March 20, 2020, and June 29, 2020, and such amount is paid on or before 30th June 2020, then for the period of delay interest will be chargeable at the rate of 0.75% per month (or part thereof). However, no penalty shall be levied (or no prosecution shall be sanctioned) in respect of such payment for the period of delay.

Where the tax is deducted by the officer of the Government:

- on the same day where the tax is paid and

- on or before 7 days from the end of the month in which the deduction is made.

In any other case,

- on or before 7 days from the end of the month in which the deduction is made and

- on or before 30th April, where the income or amount is credited or paid in the month of March.

Time Limit for TDS Certificate

When to issue TDS certificate (Form 16A) u/s 194C on payment to contractor (A.Y. 2023-24 F.Y. 2022-23)?: The payer/deductor is responsible to issue TDS certificate within the time as given below. The payer should issue form 16A within 15 days from the due date of furnishing the statement/return. So the following is the time limit to issue of Form 16A for payment to contractor including Sub-contractor.

| Quarter Ends | Time Limit |

| 30th June | 15th August |

| 30th September | 15th November |

| 31st December | 15th February |

| 31st March | 15th June |

TDS Returns (TDS on Contract Payment u/s 194C)

When are the due dates to file TDS return u/s 194C: The payer should submit TDS return/statement for A.Y. 2023-24 F.Y. 2022-23 in form no. 26Q for the payment to contractor including sub-contractors on or before

| Quarter Ends | Time Limit |

| 30th June | 31st July |

| 30th September | 31st October |

| 31st December | 31st January |

| 31st March | 31st May |

Other Important Points

Examples of work contracts

Bank charges, oral contracts, piece rate contracts, advertisement contracts, broadcasting contracts, travel agents, airlines, clearing & forwarding contracts, courier agencies, catering contracts, Professional & technical services and other contracts.

No TDS deduction on Payment to Transporters if PAN furnished

If the operators furnish his PAN to the deductor then the deductor should not deduct TDS. But the deductor will give the valid ‘PAN’ detail in the ‘Quarterly returns of TDS’ of the deductees within the time limit to get the exemption. It will be done only in the case of transporters, who engaged in the business of plying, hiring or leasing goods carriages.

On which amount does TDS have to be deducted?

TDS will be deducted from the amount credited or paid for the services used. However, in the case of manufacturing or product in which the services have involved then the amount to deduct TDS is only for the service used if it is mentioned in the invoice. However, if there is not a separate amount for service, then the TDS will be deducted generally on the total amount of invoice.

Contractor and Sub-contractor

Giving service to someone for the price is called a contract. The service provider will be called the contractor. The contractor’s duty is to complete the task for which an agreement has executed. When a contractor further enters into a contract with another person to do the jobs completely or part that is called a sub-contractor.

It may be any work, deduction u/s 194C will be applicable when the contracts are made for any work. The following are the positions when the liability will arise.

our vendor has given on ebill for 40000 which we have deducted tds and now has given rs 10000 do we have to deducted tds

In view of GST, if the service provider prepares a bill with Supply and service combined on what amount TEA is applicable

if the customer has crossed 100000/- limit at the end of March-2017 so TDS should be deduct on all bills amt. like that april to march-2017 …..? . please sir suggest

I wants to know the TDS return filling software . how to download , execute. Step by step needs help & from where software of tds return filling can be download.

How to amend TDS entries like PAN, amount , customer etc

Hello Sanjiv, You can check this article, here we provided complete information about TDS Return. Thanks https://alerttax.in/tds-return/

Dear Genies

Here one doubt , we explaining

Handling Charges 1000

storage rent 1000

service Tax 300

Total 2300 this is example

we are having two type of TDS Head on Single Invoice. How to calculate what is TDS act telling we confused. whom know the answer kindly share me

Can we deduct TDS on Cable Company who are issuing Invoice stating it is Rental Charges

we have taken services from vendor, vendor issue us invoice E.g. Rs 100000/ and we are recover some canteen amount Rs. 10000/ net payment due Rs. 90000/- so please advice we need to deduct TDS on which amount. 100000/ or 90000/.

I need to know the TDS on cab operating services

rate of TDS on works contractor

Can u tell me rate of TDS on works contractor

is tds applicable on fuel surcharge IN courier bill?

TDS will be deducted only Gross amount of Bill excluding service Tax.

as per rule.

we can deducted tds on professional bill tds deduct without including service tax amount only deduct basic

amount on professional bill.

if, your bill -20000.00

service tax-2900.00

tds deduct this bill on 20000,

tds amount- 2000 only.

tds 2% on bill value means including tax or not?????

Can u tell me rate of TDS on works contracts

IF we have paid the advance of transporter in may -15 , and the bill will be received in the month of june -15 .So kindly advise we will deduct the tds or not

Yes Shakun, you have to deduct TDS when advance payment has done.

When TDS is apply on supply bill

Is tds is applicable even though there is no invoice raised by the contractor?

we raised invoice in single (including supply and service bill ) of Rs.300000 and tds deducted on whole amount like Rs.6000 on supply and Rs.3000 in services.but the deductee will deposited of Rs.3000 in TDS file return and not deposited of Rs.6000.Then what amount we claim at the time of TDS Return File. and please tell me how will i recover of Rs.6000 from the client.

maharaj contruction is treated in range of t d s deduction 2% or indvidual &treated as 1% rate for tds on bill amount

subodh gupta is take a work in own name “subodh gupta” is treated individual &tax dedution rate is 1% or named others &charge 2%tax deducted on his bill please clear

I did a sub contract with Gov. company. it is around 4 lacks job. now the company say.. they will cut 10% TDS from my full amount. is that true? its in maharshtra.

sir I am in FCi. FCI engaged State government’s contractor for handling and transport work with composite rates.State government paid to its contractor and now claiming the bill as reimbursement without any supervision charges.

State government has not deducted any such amount of TDS from the bill of contractor in case of composite rate of contract and now they are raising the bill without TDS chalan.

so now please suggest me that should i deduct the TDS or wanting TDS chalan from STate Government .

Please try to understand me and suggest me

Thanking you

Pls suggest, TDS rate for propriatory firm or individual PAN. Pls suggest which rates are apply for piece rates works or labour work. Or which section or clouse under tds deduct.pls suggest.

DTDC Courier rasid a bill Rs 13819 Charges for carrying documents & 30% Rs 4146 for Fuel Surcharge & Service Tax 12.36% on Rs 13819+Rs 4146 = Rs 17965 ST Rs 2220.47 Total Bill Value Rs 20186. then we which amount deducted TDS please sugest

when we pay to the Printer for printing job in a f/y in a bill 30,000/= added bills more than 75000/= TDS to be deducted or not, expecting your reply, regards

is it necessary to deduct TDS on AMC services (category : Maintainance or repair services of machines)

i have to pay railtel internetbandwith charges payment how to dutuct tds whether including service tax or else excluding service tax

i am having a query regarding TDS for contract based teachers…can u help me ..i have no idea about all this things….i was working on contract as teacher in training institute with salary Rs.4000/- pm. I worked for 12 months and by totalling varing amounts i got in this 12 months is approx. Rs.43,000/- . I left the job on 31 Jan 14 . now 2 days back i got call from institute saying they need my pan card number and as my payment is above 30,000 so i have to pay TDS 10% = 3100 rupees. I am not having any idea about this.

hope i will get an answer from you how this thing is calculated. i have already left my job 2 months back. So still i need to pay this amount??

Kindly advice

gser

but how to find out service tax component after TDS is being deducted from the total bill amount which was inclusive of service tax? when service tax liability comes i want to know what amount of service tax can be paid as tax from the whole amount which i said above. suggest me

suppose total bill amount is Rs.100000 inclusive of service tax , TDS is 10% on the which comes to 1000. so, can any body tell me what is the service tax component out of this ?

this thing is confusing me also.

bcoz somewhere i heard that service tax is not to be included while deducting tds but on this site its says it should.

Eg : amount- Rs 10,000

service tax – Rs.1450

so tds wud be deducted as per the rates for the amount which is exclusive of service tax i.e just 10000 and not total amount which is 11450. but plzz confirm this once again with someone else.

please give me information regarding TDS rates for contractors Payment

What about Government Contractor……??? What is the Rate Applicable to them??????

Explain…………….

whether a textile co has to deduct tds on jobwork expence for 2012-13

where its total turnover along with its subsidiary exceed 60,00,000 for the 2011-12??

I KNOW TDS IS APPLICABLE ON THE COURIER CHARGES, KINDLY HELP ME WITH THE LIMIT.

I HAD PAID RS.32,400.00 IN THE F.Y. 2012-13 APPROX RS.2700.00 PER MONTH SO KINDLY ADVISE WHETHER I HAVE TO DEDUCT TDS ON THE AMOUNT.

SOME WHERE I READ THAT IF ONE BILL CROSS RS.30,000.00 OR YEARLY BILL (NO. OF BILLS DURING THE YEAR) CROSS RS.75,000.00 THEN ONLY I HAVE TO DEDUCT THE TDS FROM THE BILL.

KINDLY ADVISE.

If you have paid 32400 in one shot of payment you can deduct Tds or If you deducted for each payment no problem..

HI, how can i pay the interest on TDS for contractors, i mean i need to pay the interst on tds. but it the time time of payment, i am confused to choos the section like that if i am paying the TDS on contract i choose 94C.

Please inform me the latest section code 194IA & 194IB. Whether 194IA section code refers to

TDS recovered on Rent payable/paid towards land or building & rate of TDS is it 10% & sec.code

194IB pertains to TDS on rent payable/paid towards machinery or plant. Whether under 194IB

rate of TDS is 2% & whether any threshold limit is there for 194IB.

how can i file sales tax on online????

i need to know the TDS on security charges

TDS DEPOSIT ON WHICH CODE FOR COURIER SERVICE PAYMENT

While doing Online Payment of TDS there is Company Deductee and non company Deductee, what is that?

not satisfy

suppose we gave the printer to print the visiting card of the company, broucher of the company ..etc do we have to deduct tds for the same

Section 194I Rent of Plant Machinery & Equipment Amt. Limit 180000 p.a @ 2% TDS will he deducted

Most firms deduct 1% for contractors with registered firms, however this one firm insists on deducting 2% for works contracts including supply of material, the deductions are made on the total invoice value. As per your recommendation it appears the TDS is deductable only on the service/labour component, its associated service tax and only at 1%. Have I understood this correctly?

Most firms deduct 1% for contractors with registered firms, however this one firm insists on deducting 2% for works contracts including supply of material, the deductions are made on the total invoice value. As per your recommendation it appears the TDS is deductable only on the service/labour component, its associated service tax and only at 1%. Have I understood this correctly?

i need tds rate for courier charges

1% if Individual & 2% for all others

TDS on Courier Charges @ 2%

TDS rates for individuals for making payments to contractors wrongly mentioned in your topic- rates of TDS @1% whereas in chart @2%

194C aggregate value crossed 75,000 /- will tds has to pay along with interest

i am not satisfy with that TDS will be deducted on Total amount of Bill including service Tax

What why?? Please ask your question or query regarding this, so that I can explain according to relevant section.

why