Form 26AS is a consolidated tax statement which has all tax-related information such as TDS, TCS Refund etc associated with a PAN. It is also called an annual statement. It shows how much of your tax is collected by the government. It is a consolidated statement from multiple sources like your salary/ pension/ interest income etc. In other words, you can say form 26AS is a tax credit statement with respect to a financial year which includes the following details:

a) Tax deducted at source (TDS)

b) Tax collected at source (TCS)

c) Advance tax/self-assessment tax/regular assessment tax, etc., deposited in the bank by the taxpayers (PAN holders)

d) Refund details, if issued by the Income Tax Department.

e) Details of AIR (Annual Information Report) Transactions.

f) TDS on sale of immovable Property (both for buyer & seller)

Various Ways to View & Download Form 26AS

There are 3 ways to check/ view Form 26AS

- Income tax India e-filing website

- Net banking of Authorized Banks

- The TRACES website

#1 View or Download Form 26AS on Income Tax India e-filing website

To view your Form 26AS online, you have to visit https://www.incometax.gov.in/iec/foportal –Visit Here

- Login to your account or register on the website.

- After logging in, Click on My Account on the dashboard.

- Then e-File -> Income Tax Return -> View form 26AS

- Now click on Confirm and accept terms and conditions.

- Then click on View/Verify Tax Credit -> View Form 26AS/Annual Tax Statement

- After that select Assessment Year -> View As HTML -> Click on View/Download -> Expert as PDF

- Now, the 26AS PD file is automatically downloaded to your system. Open 26AS PDf by clicking on it.

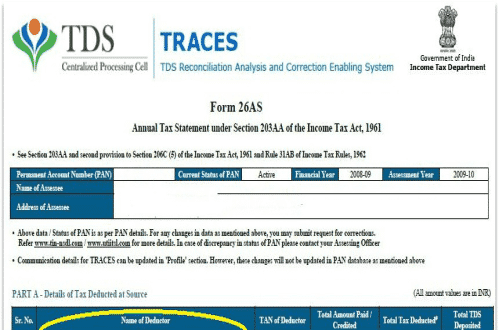

The following image represents the sample of Form 26AS.

About Form 26AS

- Form 26AS is generated annually, for a financial year.

- Form 26AS is generated whenever a tax-related transaction (TDS, advance tax paid) happens in relation to the taxpayer. It is a real-time-based document i.e. it is updated as the transactions are reported/ processed for the given FY.

- Only a registered PAN holder can view their Form 26AS on TRACES. Taxpayers can view Form 26AS in TRACES from AY 2009-10 onwards or from FY 2008-09 onwards.

- The address reflected in the Annual tax statement (Form 26AS) is picked up from the Income tax department’s PAN database with the details of the latest PAN issued to taxpayers.

- The password for opening Form 26AS will be your Date of Birth (in DDMMYYYY format). if your date of birth is 09-Oct-1982, your password will be 09101982.

Information Given in Form 26AS

- Details of tax deducted on your income by deductors

- Advance tax paid by the taxpayer

- Details of tax collected by collectors

- Regular assessment tax deposited by the taxpayers ( person who holds PAN)

- Self-assessment tax payments

- Details of the refund received by the taxpayer during the financial year

- Details of High-value Transaction in respect of shares, mutual funds etc…

Structure of Form 26AS

The Form 26AS (Annual tax statement) is divided into different parts as described below:

- Part A– Details of Tax deducted at source (amounts in INR)

This part will show the TDS deducted from salary/ pension income and TDS deducted on interest income deducted by banks. TDS deducted is shown in a separate table for every source.

- Part A1– Details of Tax deducted at source for 15G/ 15H

This part will show the transaction in those financial institutions such as banks where the individuals have submitted Form 15G/ 15H. TDS in these cases would be zero (because you have submitted 15G/ 15H). This section helps to keep a check on all interest gains which are not taxed.

- Part B– Details of Tax collected at source.

Tax Collected at Source (TCS) is collected by the seller from the buyer at the time of sale of a specified category of goods such as Alcoholic liquor for human consumption. The TCS rate varies from one category of goods. The TCS is deposited with the govt.

- Part C– Details of Tax paid (other than TDS or TCS)

Self-assessment tax or Advance tax paid by the taxpayer will be shown in this part of the Form. Whenever you deposit advance tax/self-assessment tax directly to the bank, the bank will upload that information after three days of the clearing of the cheque.

- Part D– Details of the refund received

If you have received any tax refunds during the financial year that would be listed under this part.

- Part E– Details of AIR Transactions

If a taxpayer makes some high-value transactions such as investments in property and mutual funds, that will be automatically reported to the income tax department by banks and other respective authorities through Annual Information Return (AIR).

- Part F- Details of tax deducted on sale of immovable property (for the buyer of the property)

- Part G- Comprehensive view of TDS defaults relating to all TANs associated with PAN

Arpit,

Good read and extremely informative.

Need to get in touch with you on and how we can collaborate on other projects.

Also Gurgaon based.