How to File ITR-2 (A.Y.2023-24) – Step-by-Step Procedure: You can use ITR-2 to file your income tax return if you are an individual and HUFs and earn over Rs. 50 Lakh without business income. An ITR-2 covers any income from a salary, pension, house property (More than one house property), capital gains, director in a company, unlisted equity shares, or foreign income that you receive. You should file ITR-3 or ITR-4 if you have business income. Adding another person’s income to a taxpayer’s income, such as a spouse or child, is also allowed to enter ITR-2.

Quick Summary of ITR-2 Filing

| Information | Summary |

|---|---|

| ITR-2 Updates | – May 31, 2023: Income tax department provides pre-filled data for ITR-2 online filing. – May 12th, 2023: Excel-based utility for ITR-2 released. – February 24th, 2023: CBDT releases ITR-2 in PDF format. |

| What is ITR? | ITR is an income tax return used by taxpayers to file their income tax returns. Different types of ITR forms are available depending on the taxpayer’s income sources. |

| What is ITR-2? | ITR-2 is an income tax return form applicable to individuals and HUFs not engaged in business or profession. It covers income from salary, pension, house property, capital gains, foreign income, etc. |

| Who Can File ITR-2? | Individuals and HUFs with income from salary/pension, house property, capital gains, other sources, foreign income, agricultural income above Rs. 5,000, and specific residency statuses can file ITR-2. |

| Who Can Not File ITR-2 | Individuals or HUFs with income from business or profession should not use ITR-2. Those eligible for ITR-1 or partners in a partnership firm should choose appropriate forms based on their circumstances. |

| Documents Required to File ITR-2 | – Form 16 – TDS certificates (Form 16A) – Form 26AS – Rent-paid receipts – Summary/profit-loss statement of capital gain transactions – Bank passbook and FDRs – Details of rented property – Documentation for losses and previous year’s ITR – Tax-saving deduction proofs |

| Changes in ITR-2 for A.Y.2023-24 | – New disclosure for ‘Retirement benefit income’ – Addition of ‘Schedule – VDA’ for reporting profits from VDA or crypto – Foreign Institutional Investor (FII) disclosure requirement |

| Pre-Requisites to File ITR-2 Online | – Registration on e-Filing Portal – PAN and Aadhaar linked – Active PAN – Registered mobile number linked to Aadhaar – Pre-validated bank account |

| Structure of ITR-2 | – Part A: General Information – Schedule S: Income From Salary – Schedule HP: House Property – Schedule CG: Capital Gains – Schedule Other Sources – Schedule VI-A: Deductions – Schedule 80G and 80GGA: Donations – Schedule AMT and AMTC: Tax computation |

| Procedure to File ITR-2 Online/Offline | – Online Mode: Log in to the e-Filing portal, select ITR-2, enter details, verify and submit. – Offline Mode: Use the Excel-based utility, enter details, generate XML, and upload on the e-Filing portal. |

Table of contents

- Quick Summary of ITR-2 Filing

- ITR-2 Updates

- What is ITR?

- What is ITR-2?

- Who Can File ITR-2?

- Who Can Not File ITR-2

- Documents Required to File ITR-2

- Changes in ITR-2 for A.Y.2023-24

- Pre-Requisites to File ITR-2 Online

- Procedure to file ITR-2 Online or Offline

- Structure of ITR-2

- Due Date to File ITR-2 Online for A.Y. 2023-24

- Important Links for ITR-2

ITR-2 Updates

May 31, 2023

Now, the income tax department provides pre-filled data for ITR-2 online, making it very easy to file.

May 12th, 2023

The Income Tax Department has released the Excel-based utility for taxpayers to complete the ITR-2 form. You can download it by clicking here.

February 24th, 2023

The CBDT has released the ITR-2 in PDF format for A.Y.2023-24. You can download the ITR-2 (PDF Format) here.

What is ITR?

ITR is also known as an income tax return. ITRs are used by taxpayers to file income tax returns. Different types of ITR forms are available depending on a taxpayer’s income sources. There are columns for income sources, deductions, tax liability, tax payment, and verification during the financial year on ITRs. The taxpayer files their income tax return per the status (NRI, Resident, Individual, Business, Professionals) and income sources (salary, house property, business, capital gains etc.). There are a total of 7 ITRs forms to file income tax returns. We will discuss here only ITR-2.

What is ITR-2?

ITR-2 is an income tax return form applicable for individual taxpayers and Hindu Undivided Family (HUF) who are not engaged in any profession or business. Its applicability depends upon the taxpayer’s category and source of income. It includes income from capital gains, foreign income, or any agricultural income of more than Rs 5,000.

Who Can File ITR-2?

Form ITR-2 is applicable to individuals and HUFs who receive income from sources other than “Profits and Gains from Business or Profession.” Let’s examine the eligible sources of income for filing ITR-2:

1. Income from Salary/Pension:

Taxpayers earning income from salaries or pensions are eligible to file Form ITR-2.

2. Income from House Property:

Individuals earning income from one or more house properties can use Form ITR-2 for filing their returns.

3. Income from Capital Gains:

Both short-term and long-term capital gains or losses resulting from the sale of investments, properties, or securities make individuals eligible for filing ITR-2.

4. Income from Other Sources:

Income from sources such as winnings from lotteries, horse races, legal gambling, and other miscellaneous sources falls under the category of “Other Sources” and requires the use of Form ITR-2.

5. Foreign Income:

Taxpayers having income from foreign sources are also eligible to file Form ITR-2.

6. Agricultural Income:

Individuals with agricultural income exceeding Rs. 5,000 are required to file their returns using Form ITR-2.

7. Resident Not Ordinarily Resident (RNOR) and Non-Resident:

If you qualify as a resident but not an ordinarily resident (RNOR) or a non-resident, you are eligible to use Form ITR-2 for filing your returns.

8. Director and Unlisted Equity Shares:

Individuals who serve as directors in any company or have investments in unlisted equity shares are also required to file their returns using Form ITR-2.

Who Can Not File ITR-2

While the above criteria define the eligibility for filing ITR-2, there are exceptions where individuals or HUFs should consider alternative forms. Let’s explore these exceptions:

1. Income from Business or Profession:

Individuals or HUFs whose income is fully or partially derived from business or profession should not use Form ITR-2. They should opt for the appropriate form that suits their business structure or professional income, such as Form ITR-3 or ITR-4.

2. Eligibility for ITR-1 (Sahaj):

Taxpayers who qualify for filing returns using Form ITR-1 (Sahaj) should not use Form ITR-2. Form ITR-1 is suitable for individuals with income from salary, one house property, and other sources with total income below Rs. 50 lakhs.

3. Partnership Firm:

Individuals who are partners in a partnership firm should not use Form ITR-2. They should select the appropriate form, such as Form ITR-3 or ITR-4, based on their specific circumstances.

Documents Required to File ITR-2

As you all know, there is no requirement to attach any documents for the Income tax return or ITR-2 form. The following documents are not mandatory but for your help to file your ITR-2 smoothly, fast, and error-free. You keep these documents ready on your table before starting to file ITR-2.

Form 16: Obtain Form 16 from your employer if you receive a salary income.

TDS certificates (Form 16A): If TDS was deducted from interest earned on fixed deposits or savings accounts, make sure to have Form 16A issued by the deductors.

Form 26AS: Download Form 26AS from the e-Filing website to verify TDS details on salary and other income sources. Form 26AS Simplified

Rent-paid receipts: Keep rent-paid receipts handy if you rented a home to calculate House Rent Allowance (HRA) deductions, especially if you haven’t submitted them to your employer. Use Rent Receipt Generator Online Free

Summary or profit/loss statement of capital gain transactions: If you had any capital gain transactions with shares or securities, maintain a summary or profit/loss statement for accurate computation of capital gains.

Bank passbook and Fixed Deposit Receipts (FDRs): Gather these documents to calculate your interest income accurately.

Details of rented property: If you earn rental income from a property you rented out, collect information on the tenant’s rent payment, local tax payment, and interest on borrowed capital (if applicable).

Documentation for claiming losses: Keep a record of necessary documents that verify any losses incurred during the current year for claiming loss deductions.

Copy of previous year’s Income tax returns: If you wish to claim losses from the previous year, retain a copy of the income tax returns from the prior year that discloses the loss.

Documentation for tax-saving deductions: Gather receipts and proofs for tax-saving deductions under Sections 80C, 80D, 80G, and 80GG, such as life and health insurance receipts, donation receipts, rent receipts, and tuition fee receipts, if these were not considered in your Form 16.

Changes in ITR-2 for A.Y.2023-24

There have been no significant changes to the ITR forms. It is important to note the following changes in the new ITR-2 Form.

New Disclosure Added: There is a new disclosure for ‘Retirement benefit income’. It is necessary to disclose any earlier years on which relief under section 89A was claimed.

Crypto/VDA:

- An additional ‘Schedule – VDA’ has been added. Therefore, profits from VDA or crypto must be reported.

- Under the Capital Gains Schedule, a quarterly breakup of VDA must be provided.

- VDA transactions must be reported along with dates of sale and purchase.

Foreign Institutional Investor Disclosure: Another change in the ITR-2 form for 2023-24 is that FIIs and FPIs must provide their SEBI registration number.

Pre-Requisites to File ITR-2 Online

To file your ITR-2 online, you would need the following:

- Registration on the e-Filing Portal (How to Register and Login)

- PAN and Aadhaar are linked (mandatory w.e.f. 1st July 2023)

- PAN should be Active

- You must have a mobile phone number registered with your Aadhaar card (to e-verify your Income Tax Return)

- Pre-validated Bank Account (Mandatory for income tax refund)

Title: Understanding Eligibility and Exemptions for Filing ITR-2 in AY 2023-24

Introduction:

Filing income tax returns is an essential task for individuals and Hindu Undivided Families (HUFs) in India. Among the various forms available, Form ITR-2 is specifically designed for taxpayers with income from specific sources. In this article, we will explore the eligibility criteria for filing ITR-2 and highlight the exceptions where individuals or HUFs should opt for alternative forms.

Procedure to file ITR-2 Online or Offline

Here are the ways you can submit your ITR-2:

- Online Mode – through the e-Filing portal (Completely Online Procedure Through e-Filing Portal Prefilled Data)

- Offline Mode – through Offline Utility (Partially Online Partially Offline by Downloading Excel Utility)

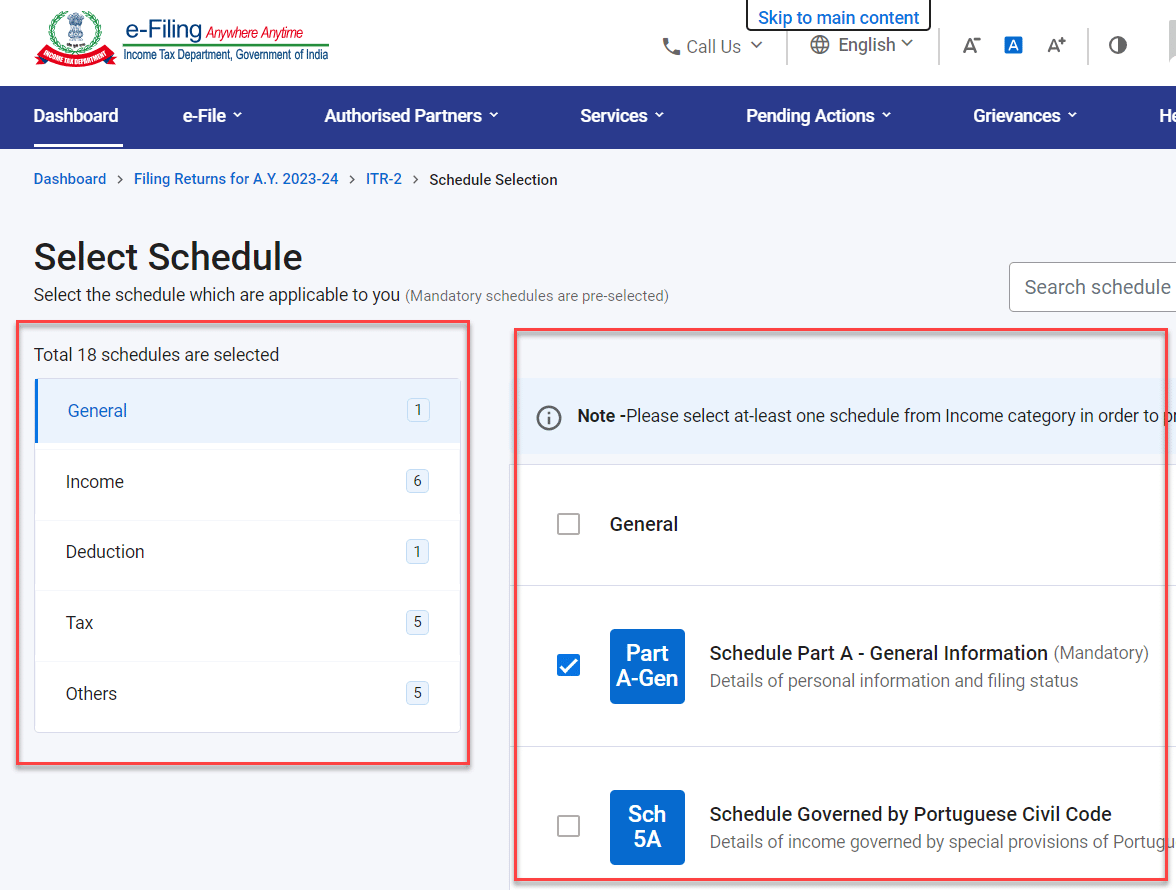

Online Mode – Through the e-Filing portal

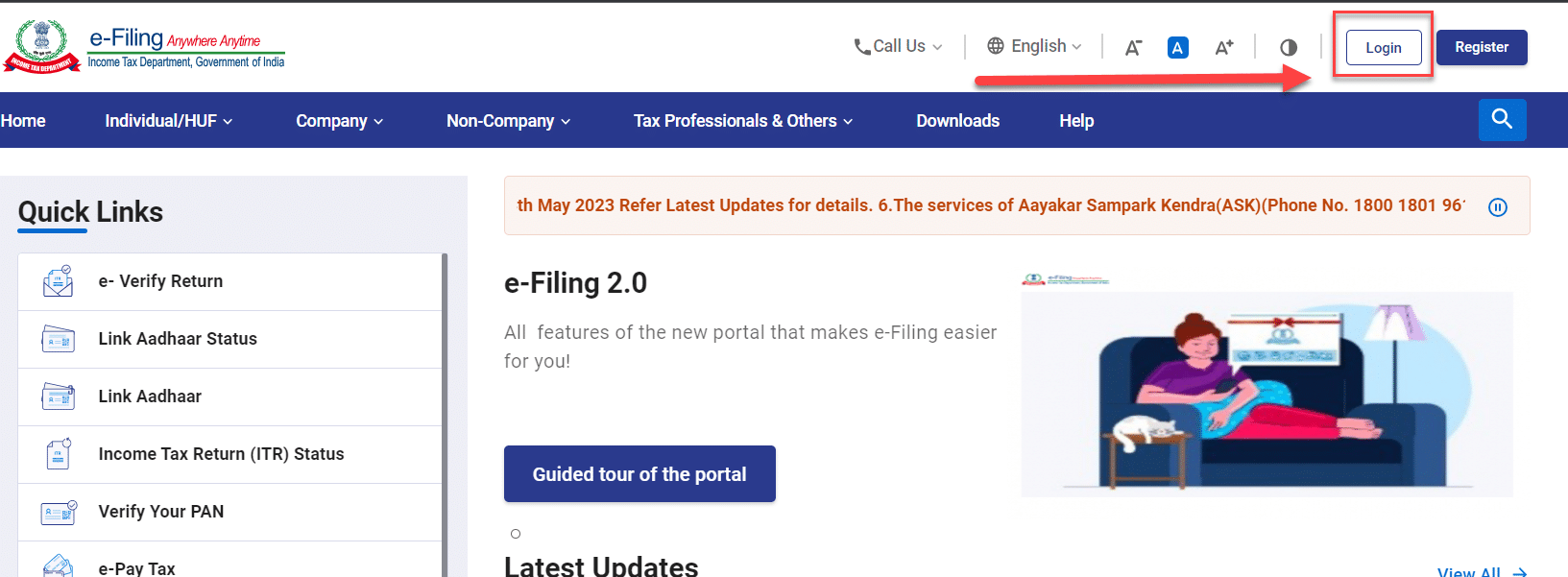

Step 1: First, you need to log into “incometax.gov.in“, which is the e-filing portal for income tax.

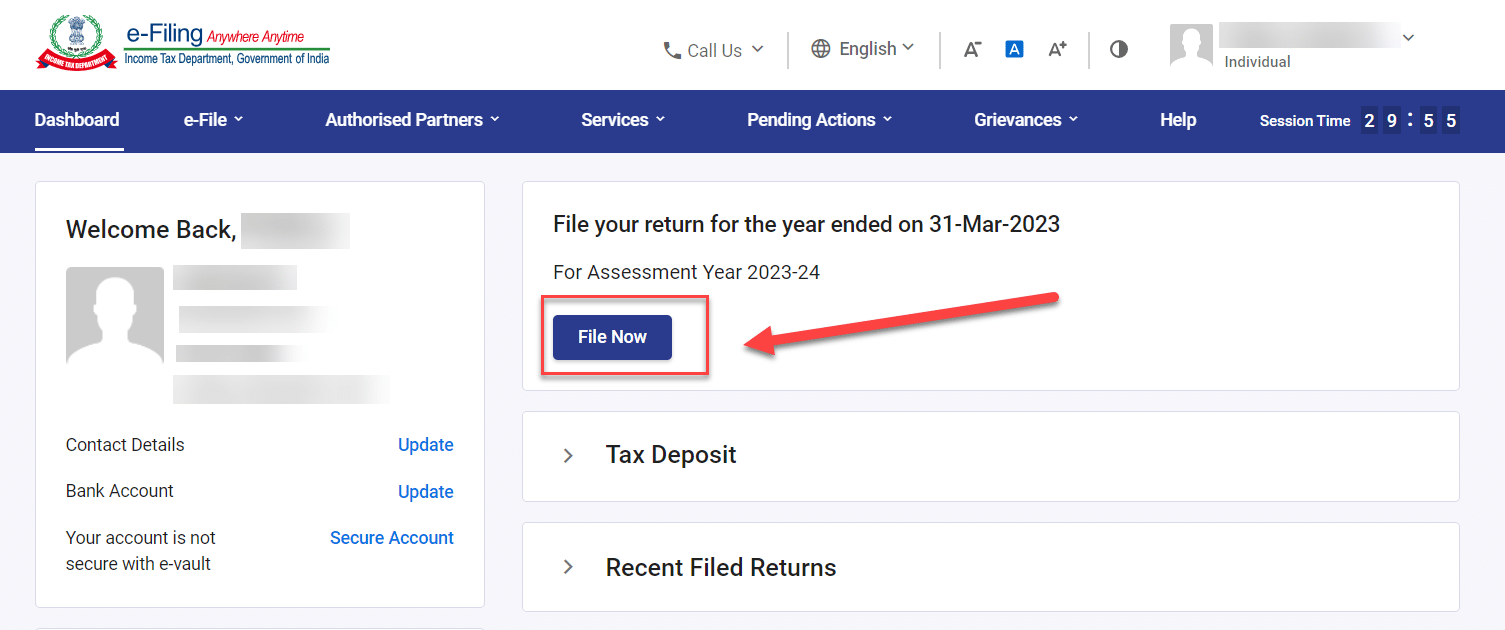

Step 2: The next step is to access your “Dashboard” after logging in. Select “e-File > Income Tax Return > File Income Tax Return”

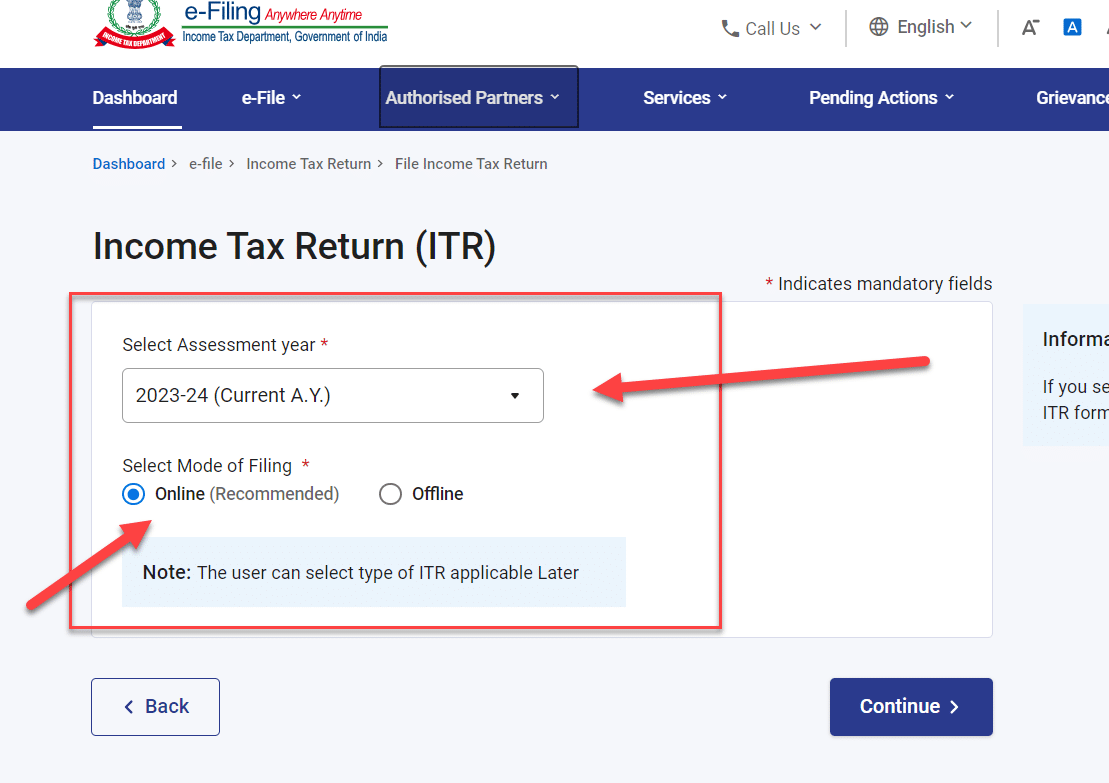

Step 3: Now select “2023-24” as the assessment year and select the mode of filing “Online (Recommended)”.

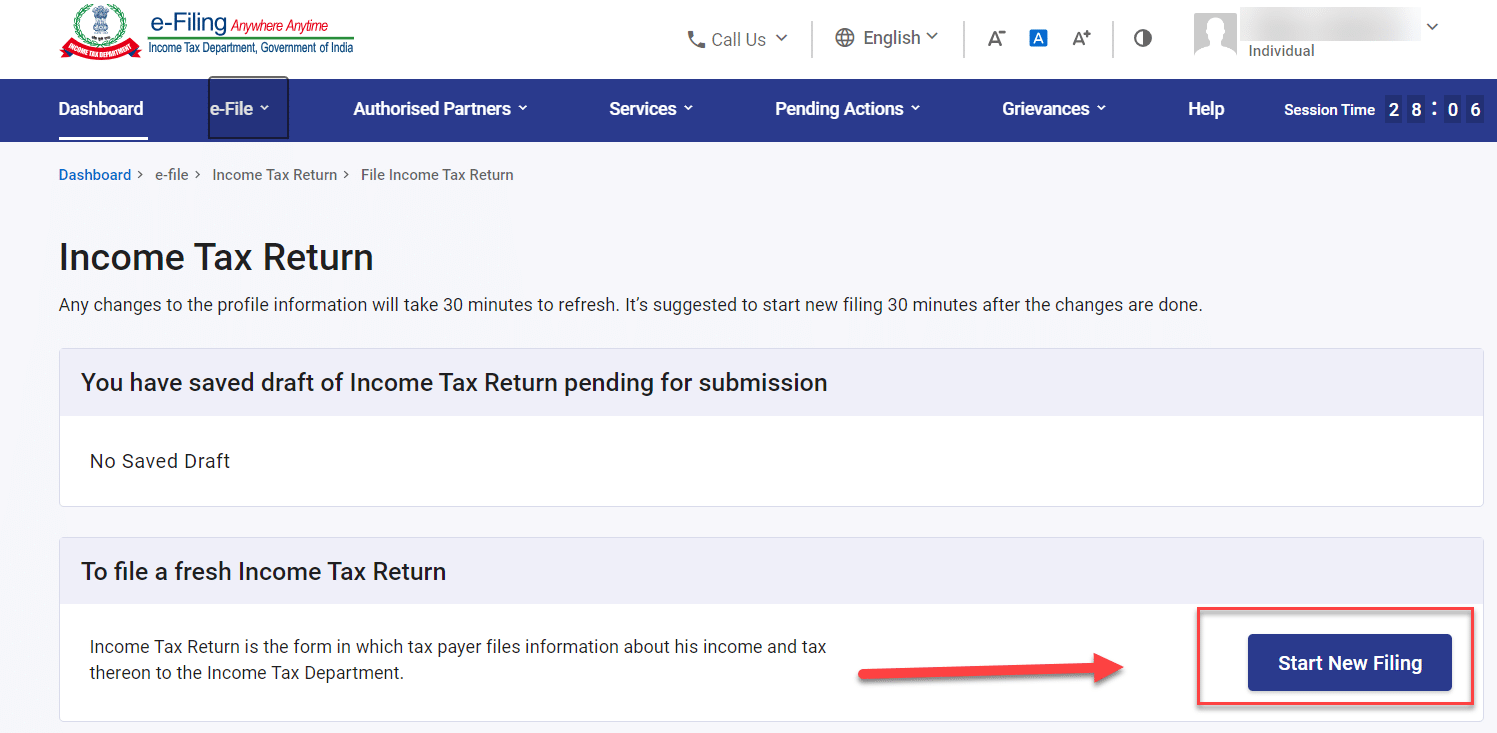

Step 4: You can click on “Start New Filing” or you can resume filing if the process of filing was interept.

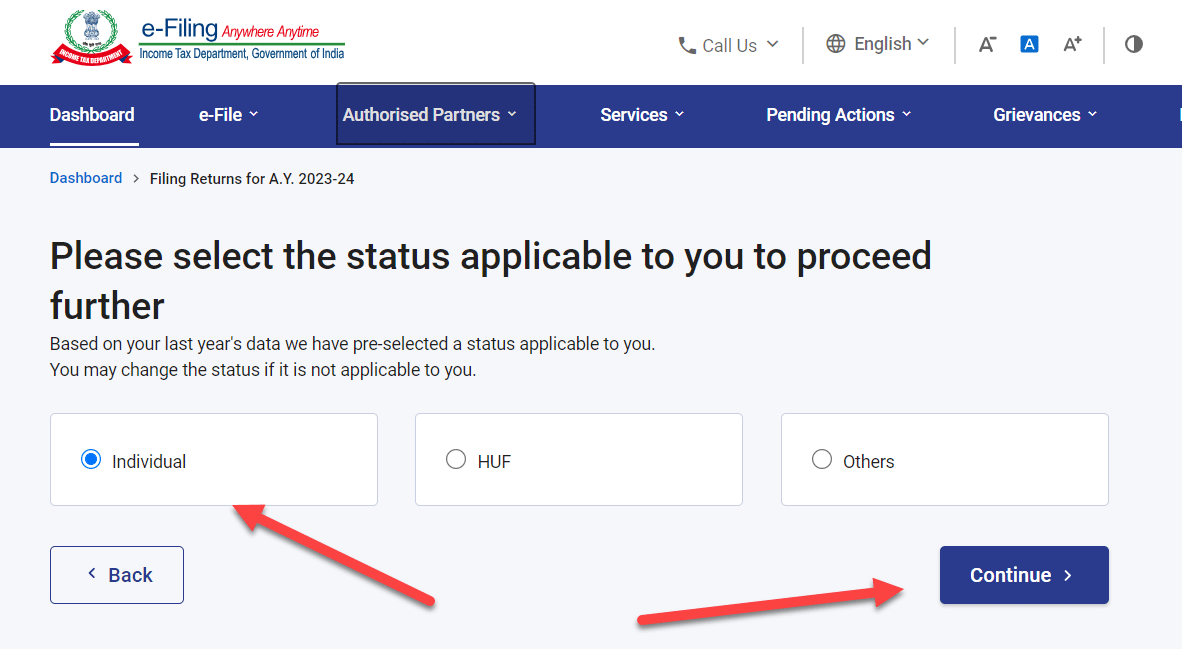

Step 5: Select the applicable status “Individual/HUF/Others”.

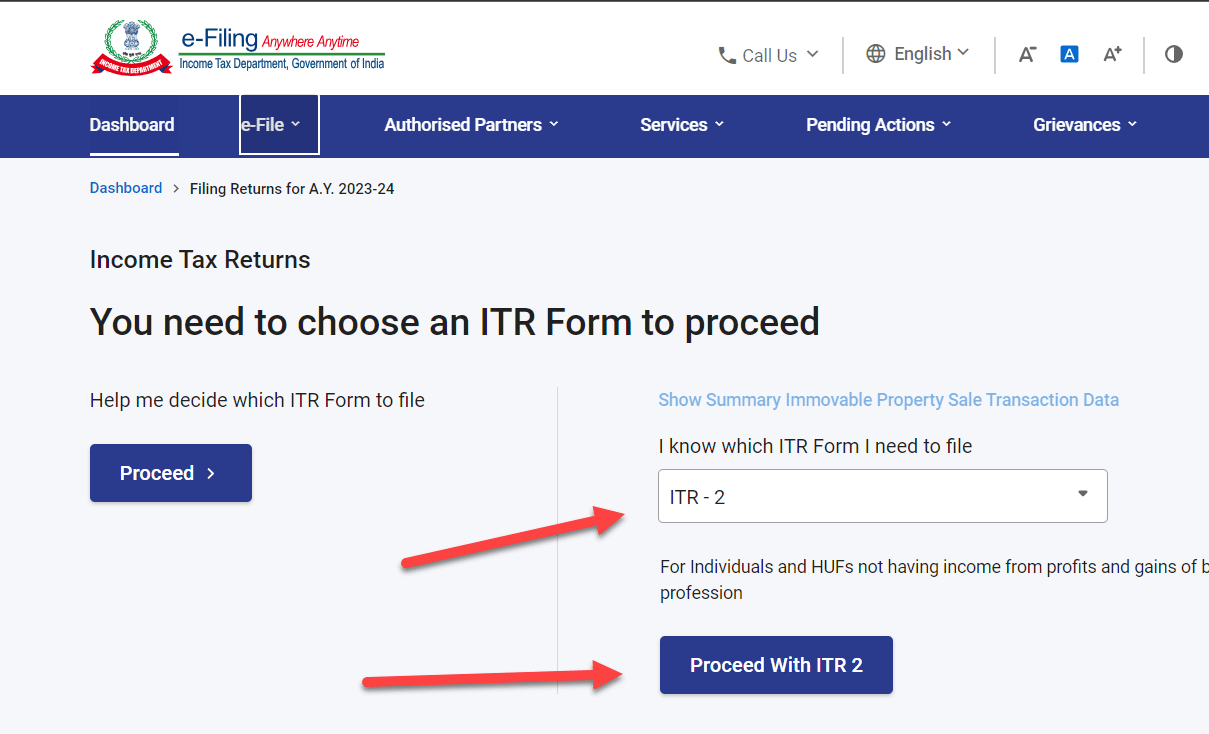

Step 6: As a next step, you must choose the type of Income Tax Return that applies to you, such as ITR-1/ITR-2/ITR-3/ITR-4.

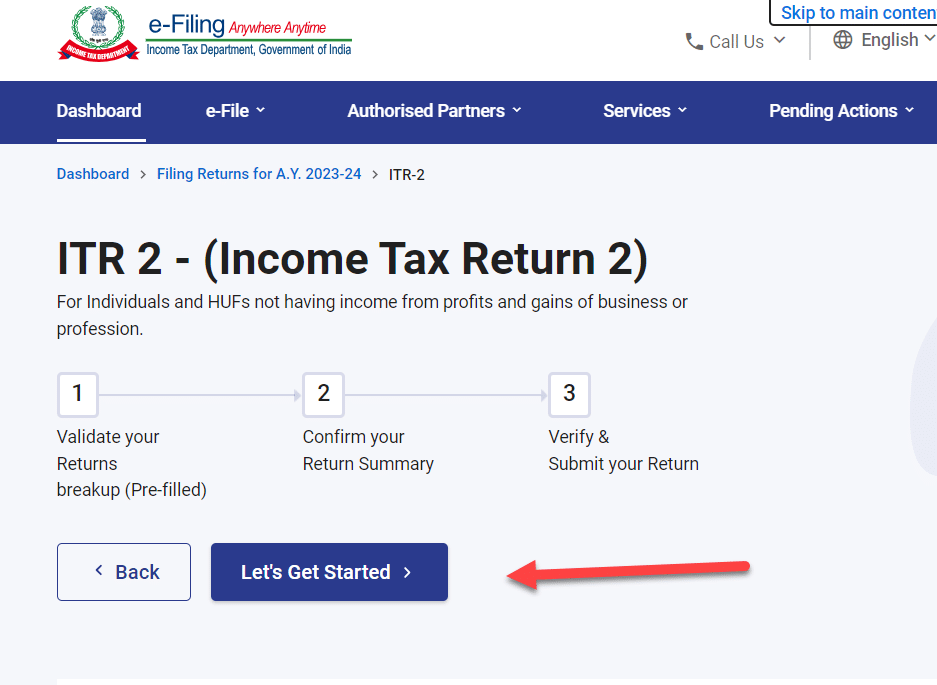

Step 7: Once you have selected ITR-2, you need to check the list of documents needed and then click “Let’s Get Started”.

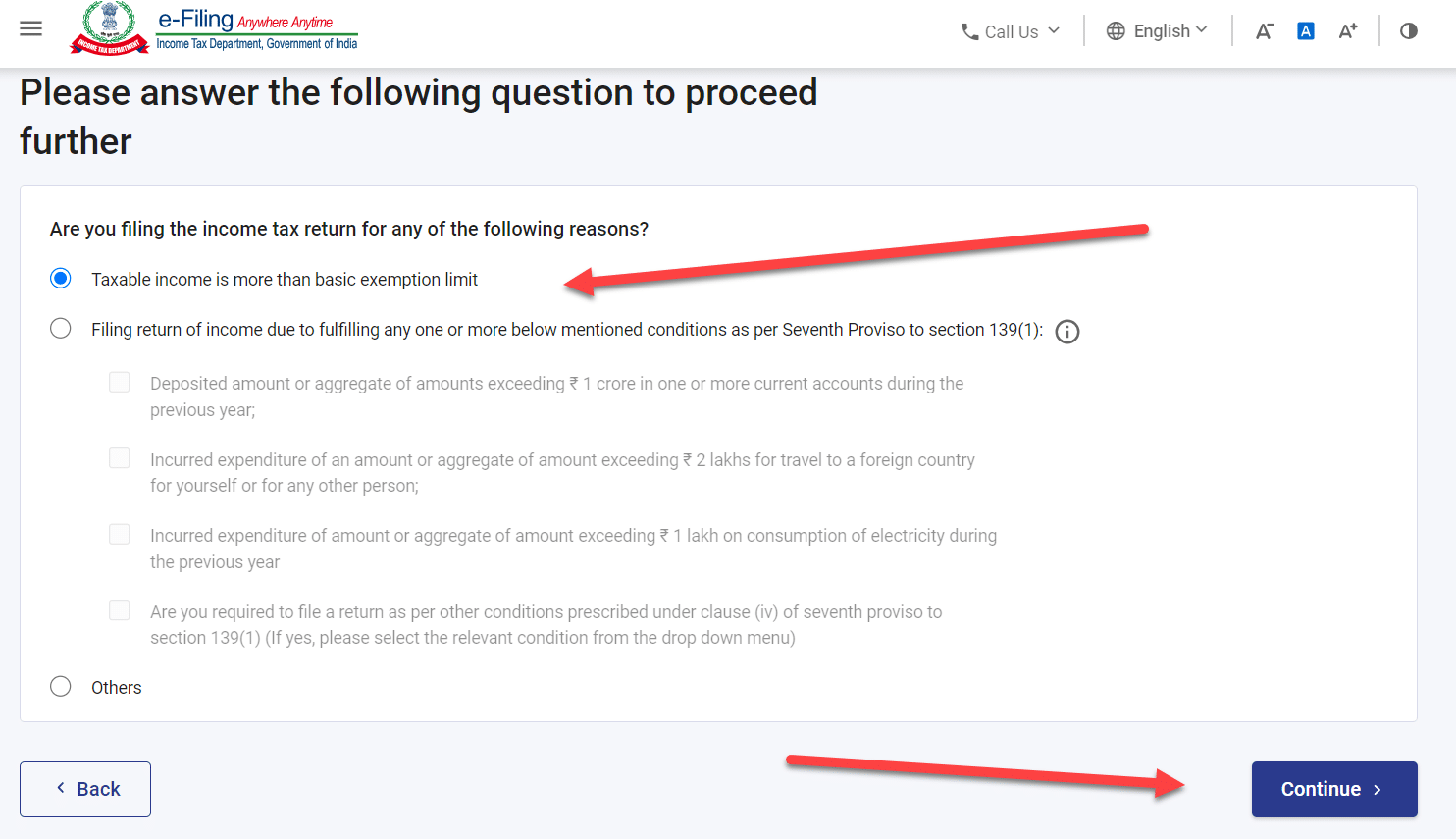

Step 8: Select the checkboxes that apply to you “Taxable income is more than basic exemption limit”.

Step 9: Check your prefilled data on the income tax filing portal. Verify and make changes if necessary. Click on “Confirm” after that.

Step 10: Enter your income and deductions for the assessment year 2023-24 (applicable to the financial year 2022-23).

Step 11: If necessary, make tax payments. For tax payments, there are two options: “Pay Now” and “Pay Later“.

Notes

Choosing “Pay Later” does not mean you can pay tax after the due date if you opt for it. Tax payments must be made by 31st July 2023 or before.

If you choose the “Pay Now” option. Enter your BSR code, Challan serial number, and tax amount carefully.

Step 12: If you are entitled to a refund of income tax because there is no tax liability. Click “Preview and Submit Return” to check.

Step 13: After that, click on “Proceed to Validation” and check the Declaration checkbox.

Step 14: Lastly, you will need to complete your certificate of an income tax return by clicking on “Proceed to Verification“.

Step 15: Your income tax return must be verified by e-Verify or by submitting an ITR-V by mail to CPC.

Structure of ITR-2

Part A: General Information

You must verify your prefilled data in Part A of the form. The form does not allow you to edit some of your personal information directly. It is possible to make the necessary changes by going to your e-Filing profile. The form allows you to edit your contact details, filing status, residence status, and bank details.

Schedule S – Detail of Income From Salary

You need to review/enter/edit details of your salary, pension, exempt allowances, and deductions as per Section 16 in Schedule Salary.

Schedule HP – Schedule House Property

You need to review, enter, or edit details relating to house properties (self-occupied, rented, or deemed rented). There are details about the co-owners, tenants, rent, interest, and pass-through income.

Schedule CG – Capital Gains

There is a separate calculation for capital gains arising from sales or transfers of different types of capital assets. Please compute capital gains for all capital assets of the same type when capital gains arise from the sale or transfer of more than one capital asset. If there is a transfer of land / building, the computation must be entered for each land / building. Your Schedule Capital Gains must include details of your Short-Term and Long-Term Capital Gains / Losses for all types of Capital Assets.

Schedule 112A and Schedule-115AD(1)(iii) provison

The purpose of Schedule 112A is to review, enter, or edit details regarding the sale of equity shares, equity-oriented funds, or units of business trusts.

Schedule 115AD (1)(iii) proviso involves entering the same details as for Schedule 112A but is applicable to non-residents

Note: The Scrip-wise details of each transfer must be entered if shares are bought on or before 31st January, 2018.

Schedule VDA- Income From Transfer of Virtual Digital Assets

You need to fill out to show how much money you made by selling or transferring your special things in a virtual world, like a video game.

Schedule Other Sources

This section of Schedule Other Sources is where you should review, enter, and edit details of all the income from other sources you receive, including special rate income, deductions under section 57, and race horse income.

Schedule Schedule Current Year’s Loss Adjustment (CYLA)

You can view details of current year income after set-off of current year losses in Schedule Current Year’s Loss Adjustment (CYLA). In the event that there are losses that cannot be carried forward from this year to the next, they are taken to Schedule CFL for carry forward into the next year.

Schedule Schedule Brought Forward Loss Adjustment (BFLA)

You can view details of income after setting off brought forward losses of earlier years in Schedule Brought Forward Loss Adjustment (BFLA).

Schedule Schedule Carry Forward Losses (CFL)

You can view details about losses to be carried forward by viewing Schedule Carry Forward Losses (CFL).

Schedule VI-A

Schedule VI-A allows you to claim your deductions under Section 80 – Parts

Schedule 80G and Schedule 80GGA

You need to provide details of donations eligible for deduction under Section 80G and Section 80GGA in Schedule 80G and Schedule 80GGA.

Schedule AMT

You must confirm the computation of Alternate Minimum Tax pursuant to Section 115JC in Schedule AMT.

Schedule AMTC

You need to include details of tax credits under 115JD in Schedule AMTC.

Schedule SPI

You have to add specified people’s income to Schedule SPI (e.g. spouse, minor child) if it’s includable or must be clubbed with your income.

Schedule SI

It is possible to view the income that is subject to a special tax rate in Schedule SI. Amounts under various income types are taken from the relevant Schedules, such as Schedule OS and Schedule BFLA.

Schedule Exempt Income (EI)

You need to provide your details in Schedule Exempt Income (EI) if you have any exempt income, which is income not included in total income or not taxable. This schedule includes interest, dividends, agricultural income, any other exempt income, income not chargeable to tax through DTAA, and pass through income which is not chargeable to tax.

Schedule Pass Through Income (PTI)

According to sections 115UA and 115UB, you need to report business trust or investment fund pass-through income in Schedule Pass Through Income (PTI).

Schedule Foreign Source Income (FSI)

You must report any income that arises from or accrues outside of India in Schedule Foreign Source Income (FSI). This schedule is only available to residents.

Schedule TR

The Schedule TR asks for a summary of taxes paid outside India which are being claimed as tax relief in India. The purpose of this schedule is to summarize the detailed information in Schedule FSI.

Schedule FA

You need to provide details of any foreign assets or income derived outside India in Schedule FA. A Non-Resident or Not Ordinarily Resident need not fill out this schedule.

Schedule 5A

You must fill out Schedule 5A if you are subject to the Portuguese Civil Code 1860 system of community of property.

Schedule AL

It is mandatory to disclose movable and immovable assets as well as liabilities related to such assets if your total income exceeds Rs. 50 lakh. The details of assets located in India are to be given only by non-residents or residents but not ordinarily residents.

Total Income (TI)

Your computation of total income (TI) will automatically be displayed in the Part B – Total Income (TI) section.

Tax Paid

In the Tax Paid section, you need to verify the tax details you paid in the previous financial year. This includes TDS from salary / TDS from income other than salary, TCS and Advance Tax.

Part B-TTI

It is possible to view the overall computation of income tax liability in the Part B-TTI section.

Due Date to File ITR-2 Online for A.Y. 2023-24

Here are the due dates to file ITR-2 for audit cases and non-audit cases.

| Category of Taxpayer | Due Date for Tax Filing- FY 2022-23 *(unless extended) |

| Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) |

31st July 2023 |

| Businesses (Requiring Audit) | 31st October 2023 |

| Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) |

30th November 2023 |

| Revised return | 31 December 2023 |

| Belated/late return | 31 December 2023 |

Important Links for ITR-2

The official website provides resources such as FAQs, e-filing facilities, and other useful information to assist taxpayers in filing their income tax returns accurately. It’s always recommended to refer to the official government websites for the most up-to-date and accurate information regarding income tax-related matters. Here are some of the important links related to ITR-2 Filing and submission.

| Particulars | Links |

| Official ITR-2 Online User Manual (A.Y.2023-24) | Visit Here |

| Official ITR-2 FAQ | Visit Here |

| Download ITR-2 PDF Format | Download Here |

| Download ITR-2 Excel Utility | Download Here |

| Download ITR-2 Excel Utility (Updated Versions Check) | Visit Here |

I am trying to file ITR2 as Non-Resident having LTCG. On Schedule selection, I need to provide details in Schedule ‘115AD(1)(b)(iii) proviso’ but is GREYED out for me and hence not able to select it. Please help or else let me know how can I specify LTCG for Non-residents?

Hi there, could you please let me know if you intend to file your ITR2 online or offline using utility?

ITR2 xls utility has a bug. I have faced the similar issue.

“Schedule TTI:

Check for Financial interests/Assets out of India should be filled.”

Use JAVA utility to file the ITR2. Note that you have to install Java first if it’s not already installed.

Use below link: https://www.java.com/en/download/

Once installed, click on ITR.bat file in Java utility which will open GUI.

This is much better than xls.

At “Home” tab, disable the sections that are not applicable to you e.g. ‘Schedule AMT’.

Hope this helps..

Kaps

How is Aadhaar different from any other identity issued by the government?

Hello All,

I have downloaded the Excel utility for ITR2 yesterday (22/07). The Part A General tab is greyed out and is a protected cell for input of the Aadhar No. I’m unble to proceed with the uploads as it mentions Aadhar is mandatory. Are the others facing the same issue? Any inputs to follow to get around this issue?

Hello All,

I have downloaded the Excel utility for ITR2 on 15-7-17. The Part A General tab is greyed out and is a protected cell for input of answer yes/no for Do you want to take benefet under section 115H…….and the Aadhar No. I’m unble to proceed with the uploads as it mentions Aadhar is mandatory. Are the others facing the same issue? Any inon puts to follow to get around this issue?

I also faced the same problem. please deselect and again select the status filed as individual these grey cells of UId and 15H will become green

Please deselect the status of filing and then again select it as “Individual” from drop down menu. Once its done, the grey cells of UID and 115H would get unprotected and you can enter the details. Thanks

Hello All,

I have downloaded the Excel utility for ITR2 yesterday (22/07). The Part A General tab is greyed out and is a protected cell for input of the Aadhar No. I’m unble to proceed with the uploads as it mentions Aadhar is mandatory. Are the others facing the same issue? Any inputs to follow to get around this issue?

Try it using Java utility , Aadhaar card field is editable in JAva utility

I am experiencing the same problem. Where do we look for a solution?

Please de-select the status button and again select as “Individual”. the grey cells of UID, 15H will now unlock for data entry..

Form 26 AS showing no transaction present but account showing tds for 2015-16 RS3609 on diffrent TDR linked account in the main account of SBI badkulla br .11374.TAN CALS21057B my income is below the limit.how do i get back the amount. i applied to get FORM 16 on 11/7/2017.but branch manager won’t co operate with me now what can i do and who is the authority whom i pray.

Cells to enter Aadhar No are protected. How to fill them up?

iTR2 has been fillled in excel and xml file prepared but it is not uploading the message is that the xml file is not in proper schma

whether LTCG through sale of equities after one year of procurement are taxable? However under which schedule of ITR 2 ( EI or PTI or both) these are to be shown in returns?

LTCG is not taxable if gains are within 1 lakh. but you have to file ITR2 duly filling schedule 112A

Sir i am finding difficulty in filing itr 1 in may 2015 i purchased a flat which was underconstruction and in dec 2015 i got the possession but from may to dec 2015 i paid pre emi so the total amount from may2015 to march 2016 is Rs.140356/-principal amount is Rs.10661/- and interest is Rs.129695/- stamp duty and registration Rs.52351/-total cost of flat is Rs.25lakhs including stamp duty and registration so my question is where should i take interest amount while filing itr 1 as well as proncipal and stamp duty amount also.Secondly can i claim for it if yes then what amount should i take principal,interest or stampduty and registration please help me with the amount detail.Waiting for your reply

I have gratuity from my previous employer & they issued a separate form-16 for gratuity payment with zero tax deduction as per Sec. 10 exempted income.

Should I be filing ITR-1 or ITR-2?

The calculation of tax payable in cell H34 of sheet PARTB_TI_TTI in ITR 2 utility seems faulty, as it does not calculate tax on J29.

I have sold a plot in November 2016 which I purchased in 2001.

and calculated the Long Term Capital gain as per the table and deposited the amount with a Longterm capital gain FD scheme with a nationalised bank in the month of April 16.

How could it be filled in the form. Could it require any certificate, and could it be filled immediately or after few months ( ie. 17) ? Please clarify.

Please clarify whether deposit in Post office Savings Scheme MISS is eligible for deduction under VIA

pti schedule of itr 2 2016. i have only one house which is used for own residence. there is

no any income out of that. how to fill this schedule.

I have got income from H R Consultation,house property&interest from FDs. Pl advise:-

1. Which ITR form to use.

2.Under which columns show Dividend income/exemption.

Regards.

S.kumar.

You cant show more than 20 k deduction in case of senior citizen return.

Hello

I hv downloaded ITR-2 excel utility. However when after filling partly when I try to save the partly filled excel sheets , it is not getting saved. meaning when i open back no data is saved whatever was entered.

This was not the case with earlier versions.

Please clarify that whether saving is allowed or not in between or there is some different process to follow to save partly filled ITR-2.

There seems to be a bug in the file. Sec 80D – maximum deduction is shown as as Rs. 20,000. How does one show the numbers if the eligible deduction is more than Rs. 20,000

I sold one of my flat for rs1700000 in Feb 2015 I made this home in2005 raised a home loan rs 800000and balance approx 8to10lac from myself this is a four story building I had already sold three storey from time to time the balance I have one story my rental income is 402500 invest rs100000 on national highway authority insurance 50000 and 3640 interest 52036and repay principal amount 600000 Pl calculat my income tax thanks

kindly provide to us excel utility available currently for A Y 2015-16 for efiling site

I have salary and bank interest income and want to show short term loss from shares investment. Kindly guide me as to which ITR form should I use? Also tell me the rules regarding taxability of income from mutual fund.

Is excel utility available currently for A Y 2015-16 ? Did not find it in the efiling site.

Hamen apna zati ID Number aur Pasword bazreeya email inaiat kia jae take aainda FBR office jane ke bajae apna incom tax khud online kar sken.

1. I sold a Plot for Rs. 10,40,000/- Lac on 7.3. 2014, which I had purchased for Rs 64,000/- on 2/7/1998.

2. I purchases a flat, for which I paid full amount of Rs 32,00,000/- on 14.03.2014. I took possession of flat on 19.06.2014, but its Registry is not yet done. Registry is expected by 31.03.2015.

3. I sold a house, for Rs 25,00,000/- on 29.09.2014, which I had purchases for Rs 8,00,000/- on 28.04.2006.

4. I have never reported any purchase/sale in my Income Tax Return.

Kindly give your expert advice on the following points.

1. Whether the 2 transactions carried out in March, 2014 should have been reported by me in my last IT Return which I filed in July, 2014 or nor? If, yes, what is the way out now?

2. LTCG’s in the two sales I have done.

3. Whether the purchase of flat made by me neutralizes all these LTCGs or not? If not, what should I do to save Tax.

Income from other source (i,e, RD,FD, SB ) is to show in break-up figure or I have to show total of interest accured in the ITR-2 (Salaried Individual case)?

Income from RD, SB, FD is to show separately in return ITR-3 or total of all interest ?

sir, my source of income is job work which ITR form i can use

I am a Pensioner having Other Income as Intt. on FDR,RD, SB, NSC. Deductions under Chapter VIA includes Health Checkup, Mediclaim and Intt. on NSC. For AY14-15, I filed ITR2 on 31st July 2014 calculating I.Tax as per Form16 and Statements of other income and Capital Gains/Losses. Now my empoyer traced mistake in Form-16 and advises me that the relief under 80D is Rs.5000/- maximum under Health check up which they had taken at the full amount of Rs.7,000/- Hospital Bills. I downloaded ITR-V but did not despatch it after receiving the intimation over phone from my employer. I had deposited Self-Assessed Tax on 26th July 2014 which exceeded total tax payable by over Rs.900/-. Now I want to submit Revised ITR-2. I am using ITR2 software provided by I.Tax Deptt. At the end of recalculation the software is charging penal intt for delayed submission of return under Section 139A. There is no place on the software to select Original Return or Revised Return. Pls advise me what should I do.

Hello Bisweshwar Ghosh, Yes you are right there are no option in ITR-2 for revised returns or rectify returns. Anyway don’t worry, Income Tax department has setup the options in its online portal. When you will login to your account to file ITR-2 again then it will tell you that you have already filed ITR-2. So you have to file revised return or cancel it. You can then tick the option to file revised return. It will solve your problem. Hope you will satisfy by it. If not then ask me again, I will look into again. Thanks

I am filing my ITR form 2 in the java utility and here is my question with respect to filing the ITR2 form with interest income of my minor child.

My SB interest – Rs. A < 2500

My FD interest – Rs. B < 1500

My Son's SB interest – Rs. C < 200

My Son's FD interest – Rs. D. < 3200

My Questions: 1) What amount should be filled in Schedule OS 1b (Interest Gross)?

2) What amount should be filled in Schedule VI A .p (80TTA)?

3) What amount should be filled in Schedule SPI (Income of Specified Person) against my son's name? Should it be a) Rs.D or b) Rs. D+ Rs. C or c) Rs. D+ Rs. C – Rs.1500

Basic reason for asking above questions is:

1) No matter what amount I fill for Q3, the tax amount is not getting changed.

2) Where should I mention the Rs. 1500 deduction (or exemption) allowed for income of minor child.

please give me itr form 2 a.y.14-15 in excel utility.

I filled ITR 2 and got the validation except for one issue for which I need help. I have declared STCG in transaction of share. I have not shown setting off loss against current year’s transaction or or carry forward loss. Under clause E of Capital Gains format at sl no ii shows short term capital gain as Rs 30730. This has not been validated with the remark “Total of quarterly break up in STCG 15% is less by Rs 30730”.

Request help to resolve.

Debasis Mallick

25/07/2014

I have downloaded the ITR2 utility from the Income Tax website. However, I do not find a “S” schedule. Is it a separate sheet or part of some other sheet?

I want to download ITR-2 in EXCEL Utility for A.Y.2014-15, but your link is only for A.Y.2013-14. How can I obtain the Form I need?

In ITR-2, under section of Computation of tax liability on total income section , 1a is Tax at normal rates on 15of Part B-TI, Is it the total income tax liability amount which is available in form 16?

Second problem is under section 9, that is Interest payable? what is 234A, 234B, 234C?

Third problem is related with section EI (Exempt Income), in this section again should i fill the same amount which i mentioned under section 80TTA for saving account?

please suggest me.

I need ITR -2 form for Asst.year 2014-15 in Excel format. Can u please post it to my mail ID.?

i have purchased a house. this is my 2nd house and i have taken home loan .this is my 2nd home loan. 1st one payment was completed . then after few months i have purchased 2nd home. now tell me which form is suitable for me.some one tole me form 2 is suitable for me. the deduction u/s 24 i got relief 24000 rupees from my salary. now i cannot understand where i mentioned 24000 deduction in for 2. please give me sugestion.

Password to unprotect ITR2 excel sheet.

I need to apply tax exempt for lta. Is itr2 correct? Should I attach travel proof while submitting itr?

I downloaded ITR-2 Excel file but after opening the file Error ‘Compile Error in Hidden Module: Sheet 1’ appear while entering every field

I want to download ITR-2 in EXCEL Utility for A.Y.2014-15, but your link is only for A.Y.2013-14. How can I obtain the Form I need?

Which ITR form to choose for a Senior Citizen?

how i open itr 2 excel format worksheet password

i downloaded the excel format and was filling the itr2 form.when i went into salary heading, it is saying that remove protection under unprotect sheet command and it is prompting for a password.how so i do it….please help…

I also faced the same problem, but could understand, the salary figure will be picked up from TDS-1 table for working tax liability. Strangely, income other than Salary has been picked up from TDS-2 table but not Salary amount. 2014_ITR2PRI.xls extracted from zipped Tr2 is also provided with system of generating XML file. But that also did not function. ITR2.xls is another excel form available for download and that has correctly assesses tax liability and outstanding tax has been paid as self assessment accordingly, but there is no facility for generating of XML file and therefore can not be uploaded against my PAN account. It appears upload is feasible only for ‘XML’ file. But this ‘xls’ file displays proper acknowledgement (TR5) file. What can be the remedy ? I can only send the Tr5 displayed duly signed if ‘XML’ file does not generate, ‘[email protected]’

If I have a MF TXN I have to file ITRFORM2. But in that under section “S” I have to enter Employer Name,Address,Pin Code no. when all I am getting is PENSION from PF Office Bandra,Mumbai. Please advise how I will enter the Pension data under “S” in ITR2?

i am salaried person and getting HRA from my institute and that has been included in my total salary, where should i enter HRA amount in ITR-2 and that is lessed from my salary

i am an resident-indian-individual. pl explain how much amount can i deduct in the category “interest on education loan”.

i was reading on net that – person earning exempted income above 5000 cannot file ITR1, does it mean that Salary person earning exempted income above 5000 (ie. if HRA and other allowances are above 5000, which are exempt U/S 10) will file ITR2

I have the same question as AK. What is the answer?

still waiting for exact conclusion.. have inquired a lot and found both opinions in favor of itr 1 & 2. some are saying to be on safe side u can file 2. but i am still waiting for some good ans.

Did you find any solution? I’m also facing the same problem

That’s right. You have to file ITR 2. Make sure you do not have income from business and profession

Is it sure that itr2 has to be filed if we have exempted incoe under section 10 around 50k? Also in itr2 excel utility I am not able to fill email address and mobile number(macros are enabled). How can I fill that?

You are required to fill ITR1 only. Exempt income is this case refers to Dividend Income etc, not the Salary Income component of HRA etc.

Regards:

CA Rajat Bhatla

9871466326